Time to recover - why it pays to stay invested

The theory

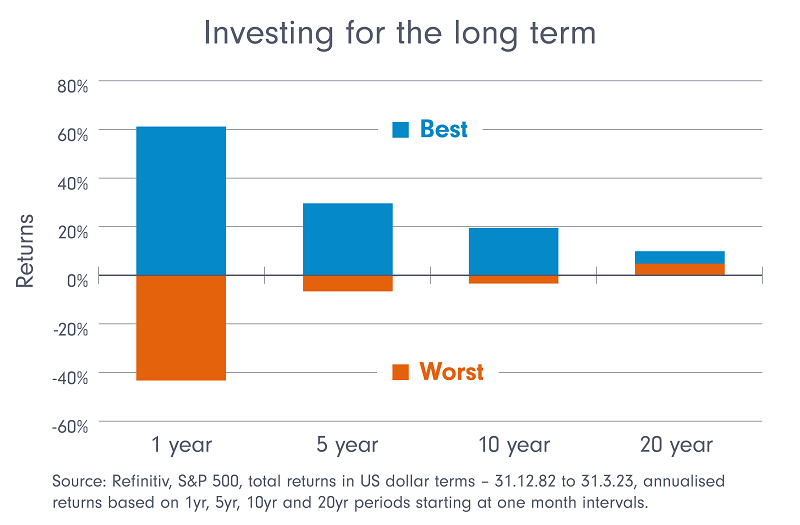

Markets rise and fall. It's a natural part of investing. History shows that the longer you're invested, the lower the chances that you'll make a loss, although this isn't guaranteed. Invest for just a year and the range of outcomes you might get is potentially very wide. The longer you stay invested, the narrower this range becomes. And the more likely it is that you'll make a positive annualised return (which basically means the average yearly return on your investments once you've sold them).

How it works in practice

This example is based on the S&P500. Past performance is not a reliable indicator of future returns.

If Sarah invests in shares for one year, she could expect - based on history - an annualised return which ranges from around minus 40% to plus 60%. However, if she invests for five years her likely annualised return narrows to between minus 5% and plus 30%. Stay invested for 20 years and the data show that Sarah's annualised return would range from plus 5% to plus 10%. In other words - the longer she's invested, the more confident Sarah can be that her return will be positive.