Investment accounts

Adult accounts

Child accounts

Choosing Fidelity

Choosing Fidelity

Why invest with us Current offers Fees and charges Open an account Transfer investments

Financial advice & support

Fidelity’s Services

Fidelity’s Services

Financial advice Retirement Wealth Management Investor Centre (London) Bereavement

Guidance and tools

Guidance and tools

Choosing investments Choosing accounts ISA calculator Retirement calculators

Share dealing

Choose your shares

Tools and information

Tools and information

Share prices and markets Chart and compare shares Stock market news Shareholder perks

Pensions & retirement

Pensions, tax & tools

Saving for retirement

Approaching / In retirement

Approaching / In retirement

Speak to a specialist Creating a retirement plan Taking tax-free cash Pension drawdown Annuities Investing in retirement Investment Pathways

In this section

Be tax-efficient

Save tax-efficiently to get your money working as hard as it can.

Important information - please keep in mind that the value of investments can go down as well as up, so you may get back less than you invest. Tax treatment depends on individual circumstances and all tax rules may change in the future. Withdrawals from a Junior ISA will not be possible until the child reaches age 18. You can't normally access money in a pension until age 55 (57 from 2028). This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to one of Fidelity's advisers or an authorised financial adviser of your choice.

Get tax savvy

Don't pay more tax than you need to. Invest tax-efficiently to make the most of your money.

Make the most of our tax-efficient accounts

An ISA is a tax-efficient way to invest as you don't pay income or capital gains tax on your investments. It's easy-to-access, so useful for all sorts of financial goals.

A Self-Invested Personal Pension, or SIPP, is typically for retirement, as you can't normally withdraw from a SIPP until you reach age 55 (57 from 2028). It comes with tax benefits when you pay in. And you can take 25% of your pension pot tax-free, as long as this amount is not higher than the lump sum allowance (LSA).

It's possible to save in both types of account. If you have any additional money that you'd like to invest tax-efficiently, you can invest for a child in a Junior ISA and a Junior SIPP.

How tax-efficient is each account?

Investors have a range of accounts to choose from. Each one is designed for a specific purpose. It's important you understand their differences to ensure you're investing in the right place.

| Account | Overview |

|---|---|

| ISAs | Investments can grow tax-free with no tax to pay on income or withdrawals. You can access your money when you need it. £20,000 can be contributed into an ISA each tax year. |

| Pensions | These include workplace pensions or SIPPs (Self-Invested Personal Pensions). The contributions you make benefit from tax relief up to the Annual Allowance, which is currently £60,000. If your taxable earnings in the year are below this then tax relief is limited to 100% of your earnings (or to £3,600 if you have no earnings). Gains are tax-free. 25% of money withdrawn from pensions is normally tax-free, the rest is subject to Income Tax at your marginal rate. Your money is not usually readily available until you reach the Normal Minimum Pension Age - currently 55 (57 from 2028). |

| Junior ISAs | For those under the age of 18. A child can take control of their Junior ISA at 16, but cannot access their money until they turn 18. Investments can grow tax-free with no tax to pay on income or withdrawals. The current annual allowance for a Junior ISA is £9,000. |

| Junior SIPP | For those under age 18. Ownership transfers at 18. Contribute up to £2,880 a year and the government will add £720 basic tax relief (20%) taking the total up to £3,600. Gains are tax-free. 25% of money withdrawn from pensions is normally tax-free, up to a limit of £268,275, the rest is subject to Income Tax at your marginal rate. The money is not usually readily available until you reach the Normal Minimum Pension Age - currently 55 (57 from 2028). |

| Investment Account (if you invest outside of pensions and ISAs) | If you've exhausted options for investing inside tax-efficient wrappers like pensions and ISAs it can still be worth investing even if you have to pay tax on your gains. You can read about capital gains tax here or find out about dividend tax. |

Make the most of your ISA tax advantages

The theory

This tax year's allowance is £20,000. By using your ISA allowance, you'll benefit because growth and income are tax-free. For maximum tax-efficiency, you should always use up your tax allowances where you can.

How it works in practice

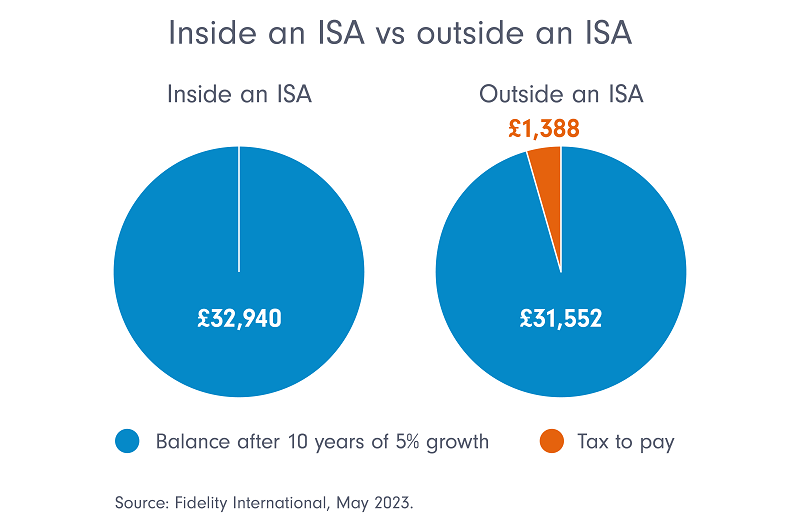

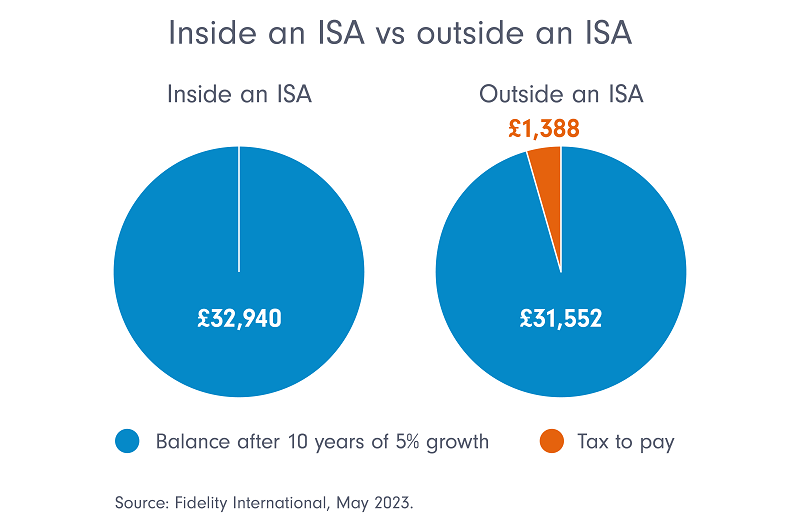

This example is for illustrative purposes only. In reality investments go up and down and charges apply.

Beth invests £20,000 in an ISA. Jez invests £20,000 in an investment account. As Beth's investments sit inside an ISA, she won't pay any tax on her investments and makes £12,940.19.

Jez has already paid as much as he can into both his ISA and SIPP, yet he wants to invest more money for himself. So, Jez opens an investment account and pays £20,000 into it. As a higher rate tax payer, Jez will have have to pay 20% tax on the gains which are above the CGT Annual Exempt Amount. This amounts to £1,388.04. As a result his total gains will amount to £11,551.79 - significantly lower than Beth's.

Jez's situation is the worst case scenario. It shows the difference that saving inside an ISA can make, assuming he didn't take steps to mitigate his CGT liability. But it does go to show how tax efficient an ISA is.

Benefit from top-ups to your pension

The theory

If you don't contribute to a pension, you'll miss out on extra money the government gives you towards saving for retirement (otherwise known as pension tax relief). You'll also miss out on the opportunity of tax-free growth. You can make use of unused tax-relief from the previous three tax years if you have used up your tax-relief for the current tax year. View our Carry Forward guide here. And when it comes to taking an income from your pension, you can normally take up to 25% tax-free, as long as this amount is not higher than your remaining lump sum allowance.

How it works in practice

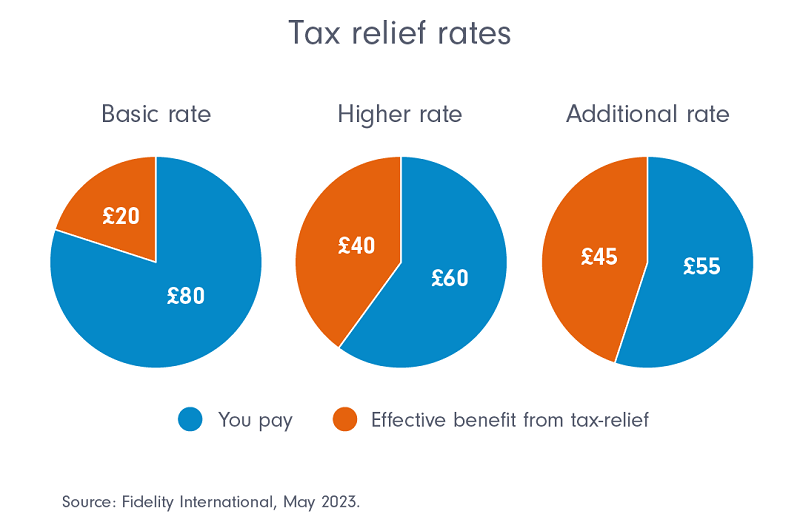

The government tops up any eligible contribution you make to a pension. An amount of tax-relief equivalent to the basic rate of tax is automatically applied, so an £80 contribution turns into £100 inside your pension.

If you are a higher or additional rate tax-payer, more tax relief may be owed to you. Most of your tax-relief will be at the basic rate of tax. But you'll be able to claim more tax relief once your salary tips you into the higher or additional tax rate band through your tax return (although you'll only get tax relief once the income at the next tax threshold reaches the value of the contribution made). This lowers the effective cost of your contribution even more. So a £100 contribution costs £60 for higher rate taxpayers and £55 for additional rate taxpayers.

If you're contributing via a workplace pension you may be given the full benefit of any tax relief owed to you automatically - otherwise you'll need to claim via your tax return.

Max out your allowances if you can

The theory

Maximising tax-efficient investments over long periods means you have the chance to build a large tax-efficient pot of money.

You can put aside up to £20,000 into your ISA in the current tax year and pay no income or capital gains tax on your investments. You can invest up to the amount of your income into a pension each year but this amount is capped at £60,000 (this cap reduces for incomes over £260,000). This is known as the pension annual allowance. You can still make contributions to a pension even if you don't have an income.

If you can, we'd recommend making the most of all your tax-efficient allowances.

To show you why, let's look at the difference maxing out your ISA allowance might have on your savings if you were in a position to do so.

How it works in practice

This example is for illustrative purposes only. The value of investments can fall as well as rise, so you may get back less than you invest. Past performance is not a reliable indicator of future returns. The return shown here does not take account of charges which would reduce these amounts.

Adil makes full use of his ISA allowance for over 20 years. If he'd invested in the FTSE All-Share (assuming he paid no charges) his total gains would have been tax free.

Learn more about your tax allowances

Five-year performance table

| (%)As at 31 July | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 |

|---|---|---|---|---|---|

| FTSE All-Share | 1.3 | -17.8 | 26.6 | 5.5 | 6.1 |

Past performance is not a reliable indicator of future returns

Source: Refinitiv, as at 31.7.23.

More principles

Invest regularly

Reduce the risk of trying to time the markets by investing regularly.

Manage risk

Avoid common investing mistakes by knowing what you're up against.

Make it last

Build a flexible income plan - so that your investments last as long as you need them to.

Start investing

Time in the market may increase your chances of investing success.

What next?

Are you ready to invest?

Before you start investing, you need to understand if you're ready. Take our quick quiz to see.

Create an account

If you're ready to invest, you need to pick an account that suits your needs. A few simple questions will help you decide.

Choose your investments

Once you've opened an account, it's time to choose your investments. We've got plenty of tools to help you do that - depending on how much support you want.

Important information - please note that these guidance tools are not a personal recommendation in respect of a particular investment. If you need additional help, please speak to an authorised financial adviser. You should regularly reassess the suitability of your investments to ensure they continue to meet your attitude to risk and investment goals.

Policies and important information

Accessibility | Conflicts of interest statement | Consumer Duty Target Market | Consumer Duty Value Assessment Statement | Cookie policy | Diversity, Equity & Inclusion | Doing Business with Fidelity | Diversity, Equity & Inclusion Reports | Investing in Fidelity funds | Legal information | Modern slavery | Mutual respect policy | Privacy statement | Remuneration policy | Security | Statutory and Regulatory disclosures | Whistleblowing policy

Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. This website does not contain any personal recommendations for a particular course of action, service or product. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Before opening an account, please read the ‘Doing Business with Fidelity’ document which incorporates our client terms. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund.

This website is issued by Financial Administration Services Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) (FCA Register number 122169) and registered in England and Wales under company number 1629709 whose registered address is Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP.