Important information - the value of investments and the income from them, can go down as well as up, so you may get back less than you invest.

INVESTORS don’t often get the chance to buy assets for less than their market value - yet one popular type of investment offers that potential.

Investment trusts pool together assets into a portfolio and investors can buy shares in the trust to gain exposure to them. But unlike traditional funds, the return investors get from investment trusts is determined by the value of the trust’s shares, which can move independently from the value of the assets in the trust. For that reason, a trust’s share will trade at either a premium or a discount.

Several UK listed investment trusts have seen their discounts widen this year. Some have moved from trading at a premium to a discount. That applies to the trusts we highlight here. Additionally, all are well-established - running for several decades and more than £1bn in size - and all are available on the Fidelity platform. We’ve highlighted one from each of four popular investment sectors.

None of this amounts to a recommendation to buy any of these trusts. If discounts have widened it is because the market does not currently believe the trust deserves to be valued more highly. However, long-term investors are always on the hunt for opportunity to access assets at attractive valuations.

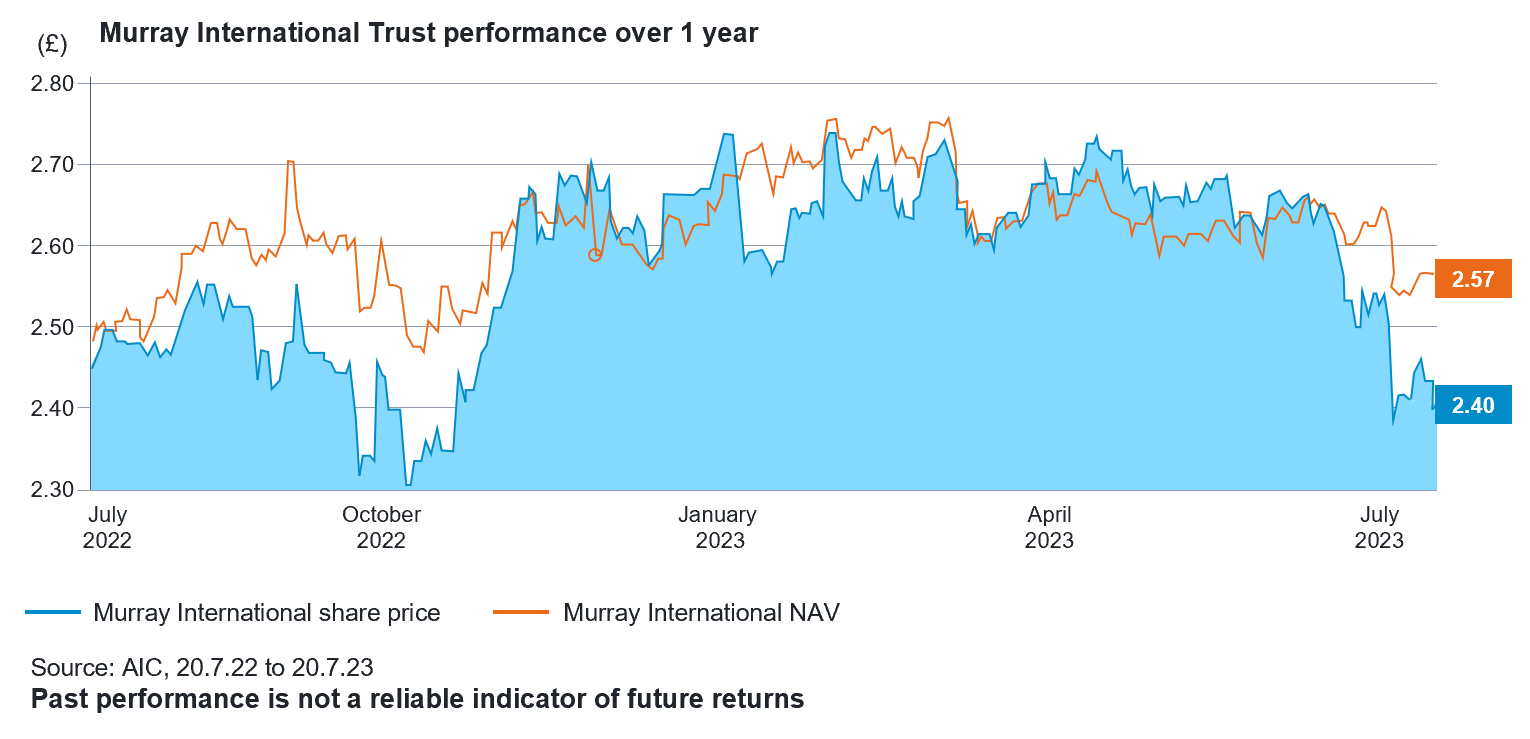

Murray International Trust

Sector: Global Equity Income

Established: December 1907

Size: £1.7bn

Current discount: -6.5%

3-year average discount: -2.8%1

Murray International Trust invests globally, but with a focus on generating income. It has a record of increasing its dividend, in cash terms, for 18 years in a row and currently pays a yield of around 4.5%, although this is not guaranteed. The dividend is all but covered by the trust’s earnings, meaning it should not have to delve into reserves to any great extent in order to maintain its pay-out to shareholders.

Murray International invests around the world but holds relatively less in the US - just 22% - when compared to many other global funds. This has hurt performance in the recent period when the US has bounced back after losses in 2022 but does mean that the trust is exposed to less-highly valued regions of the world.

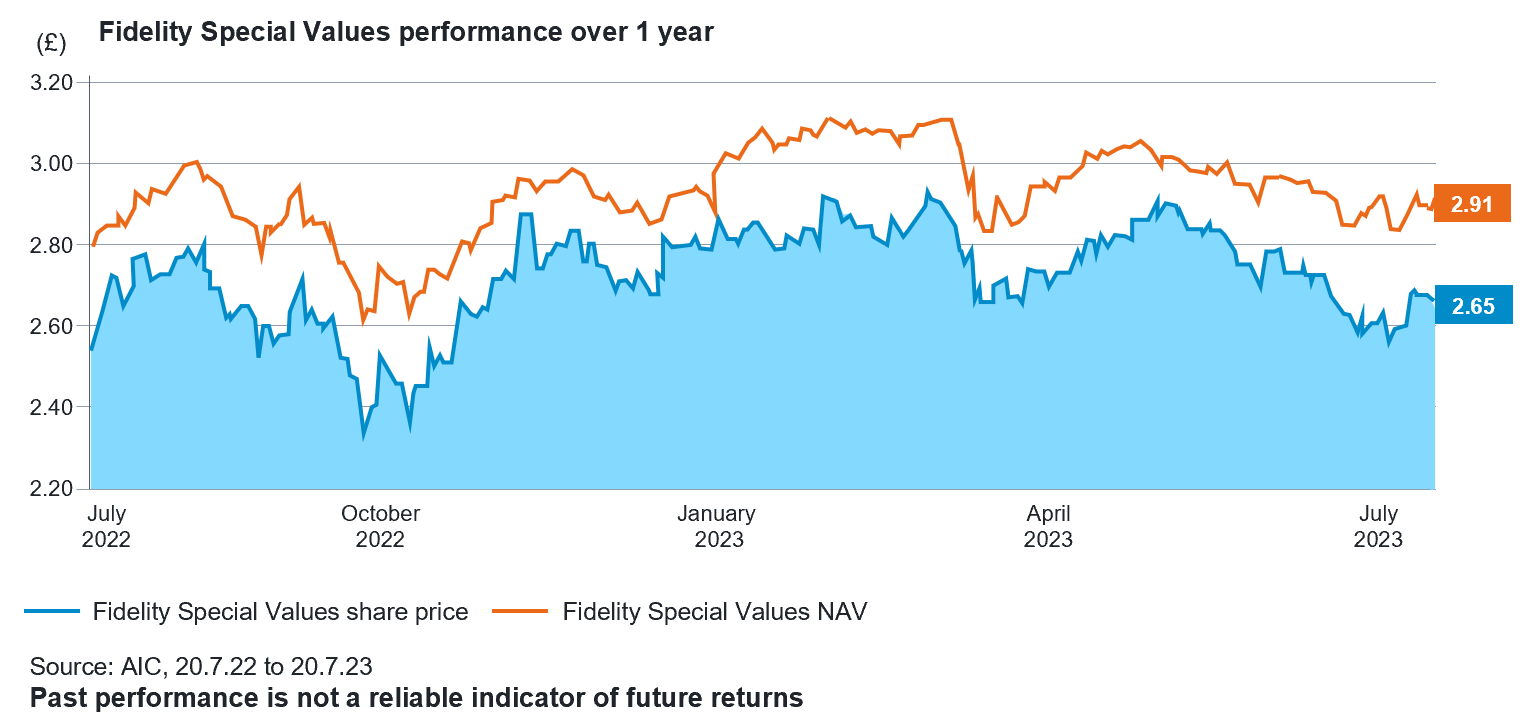

Fidelity Special Values

Sector: UK All Companies

Established: November 1984

Size: £1.1bn

Current discount: -8.8%

3-year average discount: -3.3%2

Fidelity Special Values is managed by the same team that oversees the long-running Fidelity Special Situations Fund and shares its UK mid-cap, value-oriented approach. That has left it facing headwinds this year, as the UK has lagged other major markets and medium and small-sized companies have lost ground.

Much depends on the performance of the UK domestic economy and its ability to fend off a deep recession. That perhaps explains the widening of the discount this year as investors wait to see whether inflationary fears reduce and the UK can have a softer landing than many expect. For much of its history Fidelity Special Values has traded at a premium to its net-asset value, so today’s deep discount could be attractive to long-term, value investors who are prepared to wait.

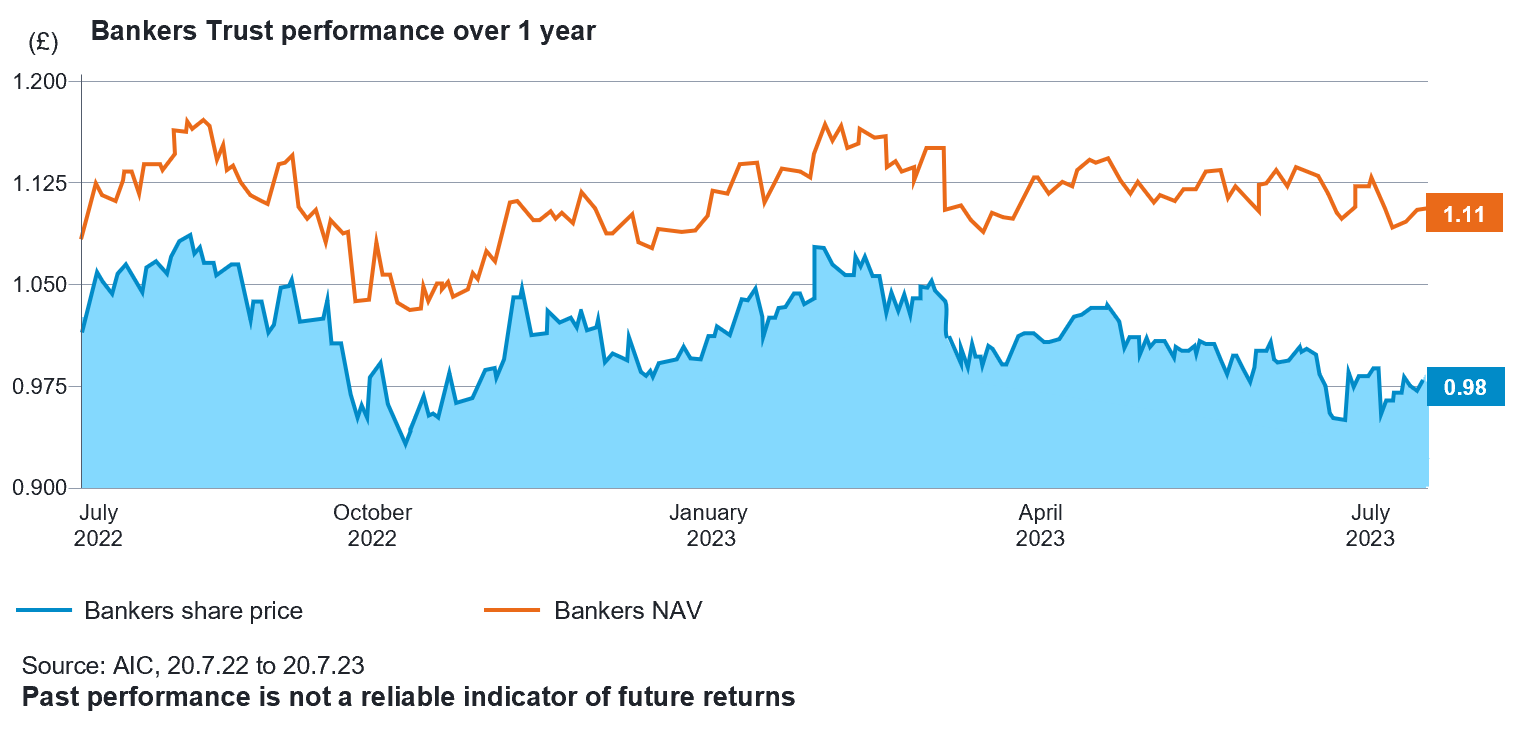

Bankers Investment Trust

Sector: Global

Established: April 1888

Size: £1.6bn

Current discount: -11.9%

3-year average discount: -3.9%3

Bankers Investment Trust can trace its origins to the 19th century. More recently, it has built an impressive record of consecutive increases in its cash payment - some 56 years and counting. The trust does not target high levels of income - the yield is currently 2.3% - but its reliable income has bolstered returns and can be a reassurance for investors.

The trust was trading at a premium as recently as early 2022 but the rapid change in the economic backdrop has seen that reverse to a discount. The trust holds its largest positions in giant US tech companies like Microsoft and Apple. Notwithstanding the recovery in those names this year, the big losses they suffered last year perhaps explains why the trust has fallen out of favour with investors.

The continued unwinding of that trend may be needed for Bankers to come back into fashion. Meanwhile this long-running trust is going cheap.

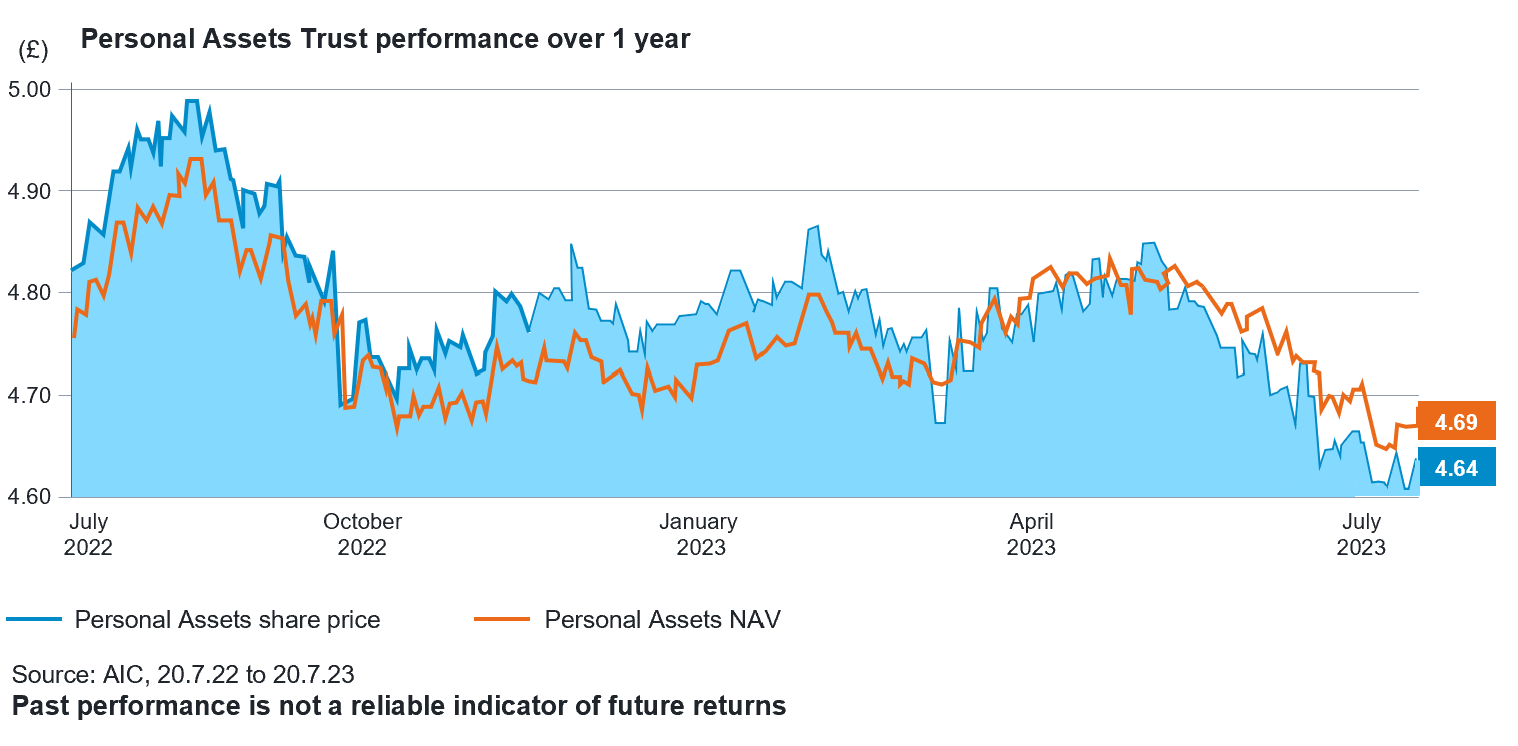

Personal Assets Trust

Sector: Flexible Investment

Established: July 1983

Size: £1.8bn

Current discount: -0.8%

3-year average discount: 0.9%4

Personal Assets Trust features in the ‘Flexible Investment’ peer group and as such is able to blend many different types of assets to meet its aim. That has traditionally been to preserve shareholder value and by using lower-risk assets like government bonds and gold alongside stocks and shares.

The result has been performance which is less explosive, but less stomach-churning, than those of rival funds. In keeping with that approach, its shares have tended to trade within a narrow range of the value of its assets, and mostly at a premium. Notably, however, the two have become disconnected recently and a narrow discount has opened up this year.

The managers of Personal Assets have pledged to keep the share price closely tethered to the value of assets - and use a mechanism of buying and issuing new shares to achieve that - so investors should not expect a large premium to ever build on the trust. Those in for the long haul, however, may be attracted at today’s valuation.

Five-year performance

| (%) As at 20 July | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 |

|---|---|---|---|---|---|

| Murray International | 5.0 | -11.6 | 22.8 | 13.1 | 9.2 |

| Fidelity Special Values | -4.3 | -27.0 | -53.1 | -2.6 | 8.0 |

| Bankers Investment Trust | 10.7 | 8.0 | 16.7 | -9.5 | -0.4 |

| Personal Assets Trust | 7.5 | 6.9 | 9.7 | 0.5 | -1.7 |

Past performance is not a reliable indicator of future returns

Source: FE, as at 21.07.23 Basis: Total returns in GBP. Excludes initial charge.

Source:

1,2,3,4 AIC - 19.7.23

Important information - investors should note that the views expressed may no longer be current and may have already been acted upon. Before investing, please read the relevant key information document which contains important information about each investment trust. The shares in these investment trusts are listed on the London Stock Exchange and their price is affected by supply and demand. Investment trusts can gain additional exposure to the market, known as gearing, potentially increasing volatility. Overseas investments will be affected by movements in currency exchange rates. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. There is a risk that the issuers of bonds may not be able to repay the money they have borrowed or make interest payments. When interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall. Eligibility to invest in an ISA and tax treatment depends on personal circumstances and all tax rules may change in the future. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

Share this article

Latest articles

Is it time to sell the Magnificent 7?

Higher for longer interest rates risk derailing the stocks’ success

Fidelity China Special Situations PLC: update from Dale Nicholls

April marks the 10th anniversary of Dale leading the trust

The 3 new “lump sum” pension allowances you need to know about

What the scrapping of the old lifetime allowance means for you