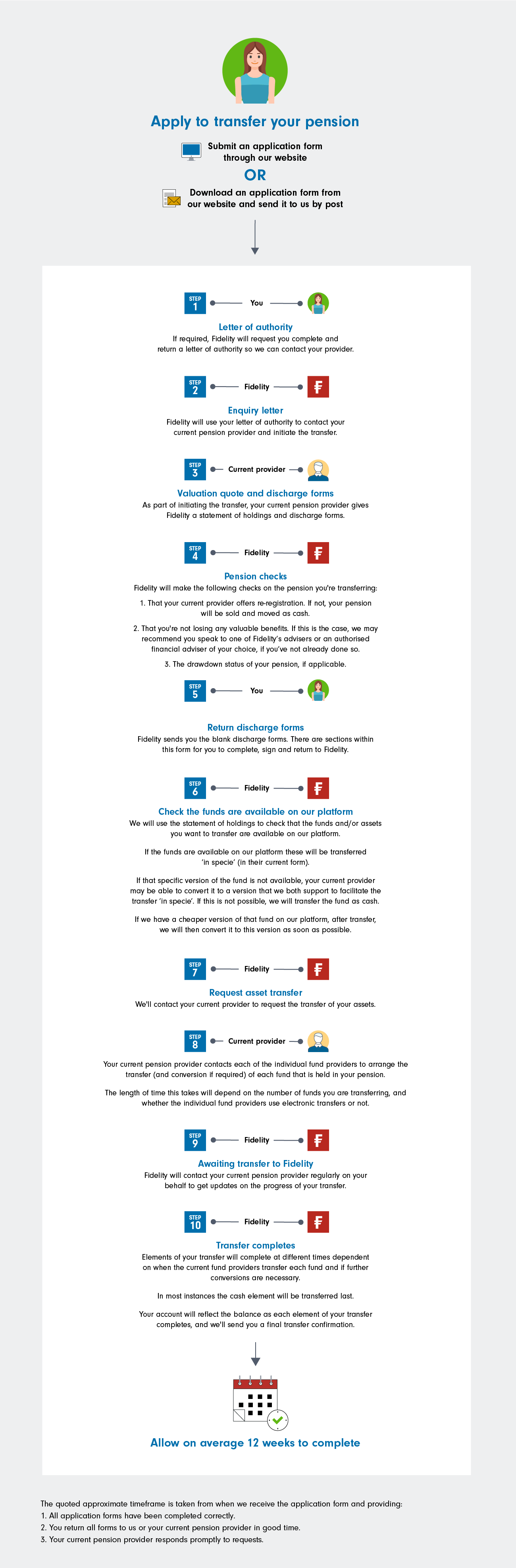

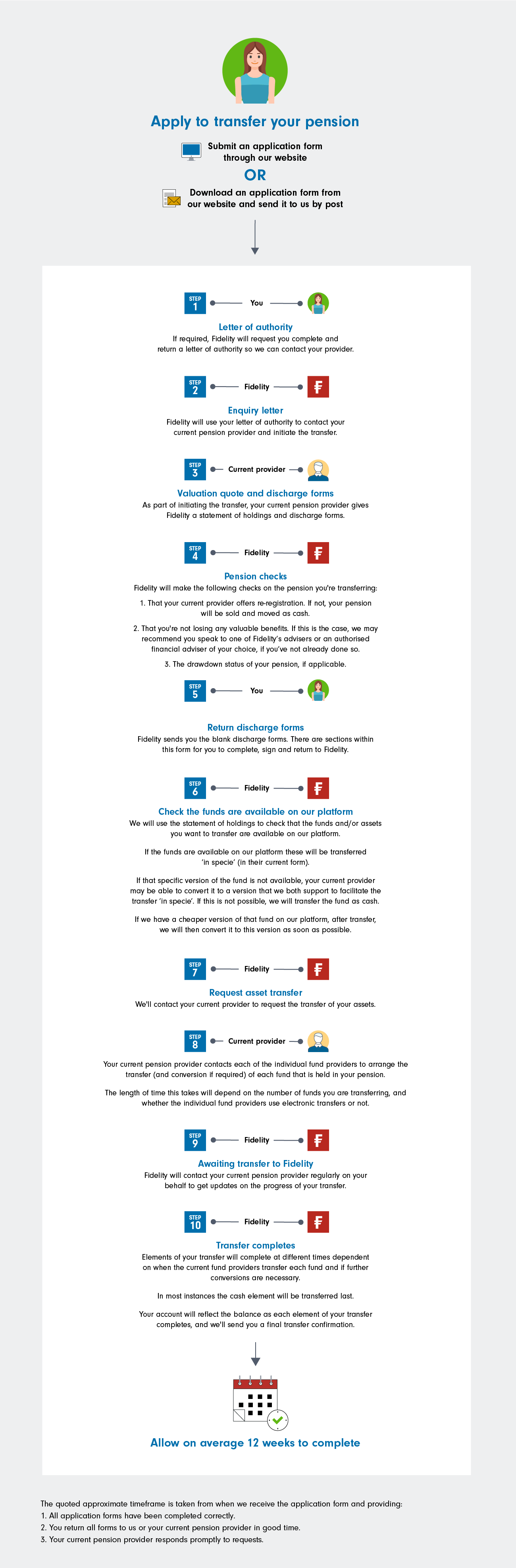

Steps involved in a re-registration pension transfer

Your transfer options

With this type of transfer option (known as re-registration) you can keep the same investments that are in your existing pension as long as they're available on our platform. We will keep you invested in the same investment (or a similar version) where possible, otherwise it will be sold and transferred to us as cash. You can check if the fund is available on our platform here.

You also have the option of a cash transfer where the assets with your old provider are sold and the proceeds transferred to your Fidelity SIPP. Once complete, you then simply choose new investments online. To see the steps involved in a cash transfer please click here.

Important information – If you are considering transferring a pension that has safeguarded benefits, guarantees or you've already started to take income from you pension (drawdown), you'll only be able to start a transfer by speaking to our retirement specialists who can provide any guidance and support you may need. They are available on 0800 368 6882.

Please note that re-registration transfers are complex and take on average 12 weeks to complete.

How it works

Below is a diagram that shows you how your re-registration transfer may work. The length of time it takes to complete your transfer will depend on a number of factors, including:

- how your original provider set your pension up

- the number of individual funds you are transferring

- how quickly your current pension provider responds to our requests for information

- whether your current provider and individual fund providers use electronic transfer systems.

The majority of transfers will be processed manually and paperwork will need to be issued to the other scheme by post. Please note though, you may also receive paperwork directly from your current pension provider asking you to confirm your intention to transfer your pension away. A small number of industry leading providers use an electronic transfer system for this type of transfer, which allows us to communicate online regarding the movement of your assets to Fidelity. Either way you will be able to apply online and we will provide you with any necessary forms at the end of the application.