Important information: the value of investments can go down as well as up so you may get back less than you invest.

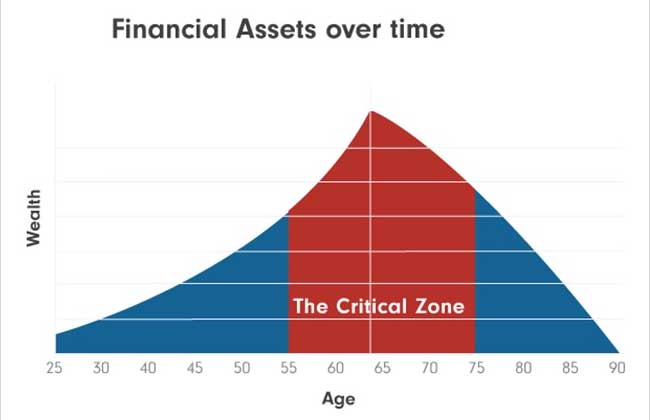

IF you’re nearing the so-called ‘critical zone’ - a period referred to as the ten years before retirement, and the ten years after retirement, the question of ‘how much do I need in my pension to live comfortably’, is probably front of mind.

Of course, there is no ‘one-size-fits-all’ answer to this question. Your overall wealth, health and wellbeing will play a role, not to mention your ongoing financial responsibilities. You may have adult children or grandchildren you need to support, or a bit of the mortgage left to chip away.

But analysis from Fidelity Adviser Solutions (based on research from the Pensions and Lifetime Savings Association) suggests that if you’re one of the 1 in 10 men who will live to 96 or 1 in 10 women who’ll live until 98, you’ll need an £835,000 or £870,000 respective pension pot to live comfortably. Of course, these figures don’t take inflation into account, so a £1m pot feels more realistic.1

What does a £1m pension pot buy you?

If you choose to buy an annuity, an insurance product offering you an income for life, you can bargain on anywhere between £34,833 and £64,049 a year, depending on the type of annuity you buy, as the table* below shows:

Current annuity rate examples

| Single life annuity with no annual increases | £64,049 |

|---|---|

| Single life annuity increasing in line with RPI inflation | £38,219 |

| Joint life 50% annuity with no annual increases | £60,725 |

| Joint life 50% annuity increasing with RPI | £34,833 |

*Annuity rates as of 15 May 2024 based on a healthy 60-year-old Londoner with pensions savings of £1m.

Thanks to pension freedoms, however, many people now choose to keep their pension invested and opt for pension drawdown. Pension drawdown gives you the flexibility to take whatever income you want – and change it when you need to. Your money stays invested so it has the potential to continue to grow and it can get passed onto your loved ones when you die. To work out what a sustainable drawdown strategy might look like, have a play on our Pension Drawdown Calculator.

Another attraction of drawdown is that if you have money left in the pot when you pass away, this can be left to your nearest and dearest. If you pass away before age 75, they can access the money in your pot tax free. After age 75, they will pay tax in line with their marginal rate of income tax.

But to answer the question: ‘How much will £1m buy you in pension income?’ You’re looking at a gross annual income of around £40,000 if you base it on the widely used 4% rule (also known as the Bengen rule). In theory, this 4% rule allows you to take a steady stream of income while maintaining a sufficient amount of funds that can be used to provide an income in future years - so that your retirement pot lasts as long as you do. But is that enough? Now, that’s a question only you can answer.

If you’d like to know more about how to make your pension last - our principles for good investing pages are really worth a read.

And if you’re starting to think about your retirement, the government’s Pension Wise service offers free, impartial guidance to help you understand your options at retirement. You can access the guidance online at www.moneyhelper.org.uk or over the telephone on 0800 138 3944.

Fidelity’s Retirement Service also has a team of specialists who can provide you with free guidance to help you with your decisions. They can also provide advice and help you select products though this will have a charge.

Source:

1 Retirement Living Standards, Pensions and Lifetime Savings Association, October 2023

Important information - investors should note that the views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The minimum age you can normally access your pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless you have a lower protected pension age. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

Share this article

Latest articles

Is it harder to fund retirement than it used to be?

Today’s pensions regime compared to those of the past

Stocks have just gone through the mother of all rotations

Can the rebound in small caps last?