Investment accounts

Adult accounts

Child accounts

Choosing Fidelity

Choosing Fidelity

Why invest with us Current offers Fees and charges Open an account Transfer investments

Financial advice & support

Fidelity’s Services

Fidelity’s Services

Financial advice Retirement Wealth Management Investor Centre (London) Bereavement

Guides

Guidance and tools

Shares

Share dealing

Choose your shares

Tools and information

Tools and information

Share prices and markets Chart and compare shares Stock market news Shareholder perks Stock plan guidance

Pensions & retirement

Pensions, tax & tools

Saving for retirement

Approaching / In retirement

Approaching / In retirement

Speak to a specialist Creating a retirement plan Taking tax-free cash Pension drawdown Annuities Investing in retirement Investment Pathways

In this section

Stock Plan guidance FAQs

Important information - investment values can go down as well as up, so you may get back less than you invest. Tax treatment depends on individual circumstances and tax rules may change. You cannot normally access money in a pension until age 55 (57 from 2028). Withdrawals from a Junior ISA are not possible until the child reaches age 18. This information and our tools are not a personal recommendation for a specific investment. You must ensure that the fund you choose is suitable for your individual circumstances and remains so over time. Seek advice if you're unsure.

Making the most of your stock plan awards

Fidelity Stock Plan Services and Fidelity International are separate companies that operate in different jurisdictions. While Fidelity Stock Plan Services in the US administers your stock plan, Fidelity International in the UK helps you with financial wellness, retirement savings and other long-term investing goals, to help you build a better financial future. Once your shares become available to you, Fidelity International can give you options on how to keep more of your money with tax efficient accounts, as well as offering other ways to invest for your future. That way you enjoy more control over what you choose to do next with your rewards.

Find out more about how we

can help you build a better financial future.

Account linking - managing your accounts together

Account linking allows Fidelity International and Fidelity Stock Plan Services in the US to create a better experience for you, the customer, by simplifying the way you move between your accounts.

If you live in the UK, have a Stock Plan Account with Fidelity Stock Plan Services in the US, and your employer is listed on a US stock exchange (eg S&P 500), you can link any existing Fidelity International investment accounts you may hold with your Fidelity Stock Plan Account. You'll need to have

registered for online access with Fidelity international to do this. By linking accounts, you’ll be able to quickly switch between your profile on

NetBenefits.com† and

fidelity.co.uk to see the value of your share awards (both unvested and vested) and your UK investment accounts without needing to log in to separate portals each time.

Note: If you live in the UK and have a stock plan from an employer listed on the UK stock exchange (eg FTSE 100), your accounts will already be linked. Log in to your Fidelity International profile and go to your Account Summary page to view your stock plan account.

If you fulfill the criteria in the previous question ('What's account linking and why should I link my accounts?') in terms of who can link accounts, but you’re unable to link your account this may be because your employer may not allow you to do this or your employer portal does not currently technically support account linking.

To link your accounts:

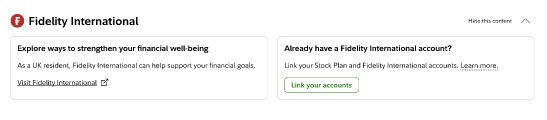

1. Log in to NetBenefits.com†. On your Stock Plan summary page, you’ll see a ‘Fidelity International’ section.

2. Click on ‘Link your accounts’. You’ll then be prompted to complete a few quick steps. Please make sure you have your Fidelity International investment account login details to hand. Please note you cannot currently link to Fidelity International Plan Viewer accounts.

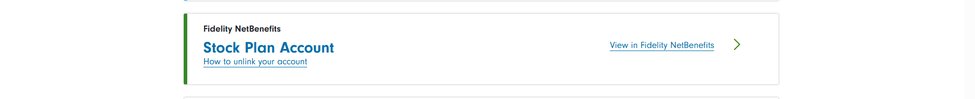

3. Once account linking is complete, the ‘Fidelity International’ section of your Stock Plan Account summary page within Netbenefits.com† will be updated with a ‘Go to my Fidelity International accounts’ button. Clicking this link will take you to your Fidelity International investment account(s) summary page.

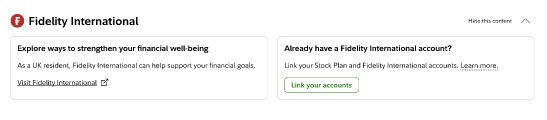

5. To switch back from your Fidelity International investment account summary page to your Stock Plan Account summary, click on the link ‘View in Fidelity NetBenefits’. This can be found under the section, ‘Fidelity NetBenefits - Stock Plan Account’.

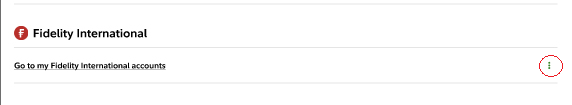

1. Log in to NetBenefits.com†. Towards the bottom of the Stock Plan summary page, you’ll see a ‘Fidelity International’ section. Click on the three dots that appear alongside the link, ‘Go to my Fidelity International accounts’.

2. Next, you’ll see an option to ‘unlink accounts'. Select this option and follow the prompt to confirm you want to unlink your accounts.

3. Once account unlinking is complete, the ‘Fidelity International’ section of your Stock Plan Account summary page will no longer show a ‘Go to my Fidelity International accounts’ link. This means you’ll no longer be able to switch back and forth between your existing Fidelity International account summary page and your Stock Plan account summary without logging in separately to each portal.

Investing with Fidelity International

Fidelity International is a global investment group with over 50 years’ experience of managing investments. We help people with financial wellness, retirement savings and other long-term investing goals to help them build a better financial future.

With Fidelity International you can enjoy more control over what you choose to do with your share awards, once they become available to you:

- Diversify your investments - choose from our wide investment choice, which includes thousands of funds and shares, to help spread your risk

- Spouse transfer - Make the most of your Capital Gains Tax (CGT) allowances by transferring some or all of your shares to your spouse

- Be more tax efficient - Investing in a tax efficient ISA or Self-Invested Personal Pension (SIPP) helps you make the most of your money with no income or capital gains tax. Fees and charges will apply. We also offer Junior ISA and Junior SIPP accounts to help you invest for your child's future

- Bring together your investments - Transfer any other investments you hold elsewhere, which could make it easier to manage them all in one place

Learn more about Fidelity International UK, what the people who matter most think about us, our awards and current offers.

If you’re new to the world of investing, it can feel like there’s a lot to learn. Build your knowledge with our Investing 101 section. You’ll be able to sign up for news, market insights and tips. You’ll also learn what investing's about and how to invest with us.

It’s worth assessing how financially fit your finances are. Take our financial wellness checkup to find out how you’re doing. It looks at the pillars of financial wellness: budgeting, dealing with debt, saving and protecting what matters to you.

- Use investment finder to find your next investment from the thousands on offer

- Find an account that meets your needs by answering a few simple questions

- Use our ISA calculator to understand how much your savings could grow if you invest with a Stocks and Shares ISA

- Our pension tax calculator and retirement calculator can help you look more closely at various aspects of your retirement, from planning your goals and your savings to working out your withdrawals

If you move your stock plan shares or cash to Fidelity International in the UK you'll have the opportunity to invest in any funds, ETFs, investment trusts and shares that are available on the fidelity.co.uk platform.

Whether you’re a beginner or an advanced investor, we can help you to find your next investment from the thousands on offer. View our investment tools to learn more.

Yes, you can set up a regular savings plan from £25 for an ISA or Investment Account, or £20 for a SIPP. A regular savings plan is effectively a direct debit payment plan where you have the option to set the payment frequency for your regular savings plan to collect monthly, quarterly, every 6 months or annually. The payments can be taken on 1st, 10th, 17th or 25th of the month, at the frequency you have chosen.

You can choose to put this money into cash or into investments which you have selected. You can edit your regular savings plan at any time (although any changes may take a few days to show online). If you move your shares or cash to Fidelity International in the UK, you can choose to set up a regular savings plan in our Stocks and Shares ISA, SIPP or Investment Account.

Allows your US shares to be settled in GBP which is shown in your account.

A CDI is a UK investment that represents an investment listed on an exchange outside the UK. We use CDIs to allow you to trade international shares in your account.

CDIs are needed because you can't settle international shares directly in CREST. A CDI lets you buy or sell the international share and settle it in GBP – exactly as you would for a GBP share. (This means any US stock plan shares would settle in GBP and be reflected in your account as such.) Dividends are paid on CDIs in the local currency of the investment and converted to GBP before being credited to your account.

Keep in mind that an FX charge (for converting the international currency to or from GBP) applies when you buy or sell an international investment, as well as when you receive dividend income and during certain corporate actions. See our foreign exchange charges for more information.

If you have a Stock Plan Account held by Fidelity SPS in the US and live in the UK, you have the option of transferring some or all of your shares to Fidelity in the UK and enjoying more control over what you choose to do next with your rewards.

Learn more about transferring stock plan shares.

Alternatively, if you hold shares from another UK investment provider,

find out more about transferring investments from another UK investment provider.

Fidelity’s Wealth Management service is specially designed for our customers who have over £250,000 invested with us (including any self-invested personal pensions), and for users of our ongoing advice. If you qualify as a Wealth Management customer you’ll get access to exclusive benefits, extra investment support and guidance including access to a personal relationship manager, to help you make the most of your wealth - now and in the future. Learn more about Wealth Management

Need further support?

Get in touch, our friendly teams are on hand to answer your questions big and small. You can even drop into our Investor Centre in London for a face-to-face chat if you prefer.

Our advice service is designed for people looking to invest a minimum of £100,000 (which can include pensions), for more than 5-years. If you're looking for personalised advice our financial advice service can help.

Please note:

- †Fidelity NetBenefits is a separate website for Fidelity Stock Plan Services in the US. Once logged in, please ensure you review the site's T&Cs and Privacy Policy as they will differ from those on this website.

- Fidelity International and Fidelity Stock Plan Services, LLC are separate companies that operate in different jurisdictions through their subsidiaries and affiliates.

- All screenshots are for illustrative purposes only.

Policies and important information

Accessibility | Conflicts of interest statement | Consumer Duty Target Market | Consumer Duty Value Assessment Statement | Cookie policy | Diversity, Equity & Inclusion | Diversity, Equity & Inclusion Reports | Doing Business with Fidelity | Investing in Fidelity funds | Legal information | Modern slavery | Mutual respect policy | Privacy statement | Remuneration policy | Staying secure | Statutory and Regulatory disclosures | Whistleblowing programme

Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. This website does not contain any personal recommendations for a particular course of action, service or product. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Before opening an account, please read the ‘Doing Business with Fidelity’ document which incorporates our client terms. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund.

This website is issued by Financial Administration Services Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) (FCA Register number 122169) and registered in England and Wales under company number 1629709 whose registered address is Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP.