Investment accounts

Adult accounts

Child accounts

Choosing Fidelity

Choosing Fidelity

Why invest with us Current offers Fees and charges Open an account Transfer investments

Financial advice & support

Fidelity’s Services

Fidelity’s Services

Financial advice Retirement Wealth Management Investor Centre (London) Bereavement

Guides

Guidance and tools

Shares

Share dealing

Choose your shares

Tools and information

Tools and information

Share prices and markets Chart and compare shares Stock market news Shareholder perks Stock plan guidance

Pensions & retirement

Pensions, tax & tools

Saving for retirement

Approaching / In retirement

Approaching / In retirement

Speak to a specialist Creating a retirement plan Taking tax-free cash Pension drawdown Annuities Investing in retirement Investment Pathways

In this section

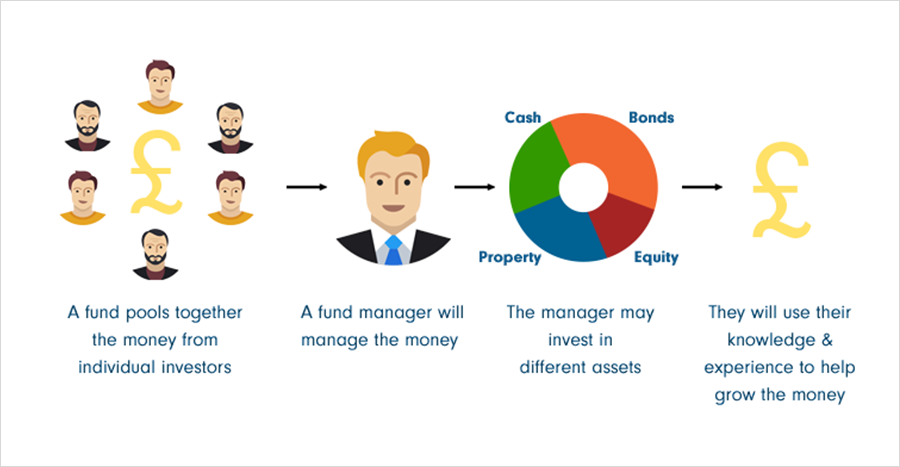

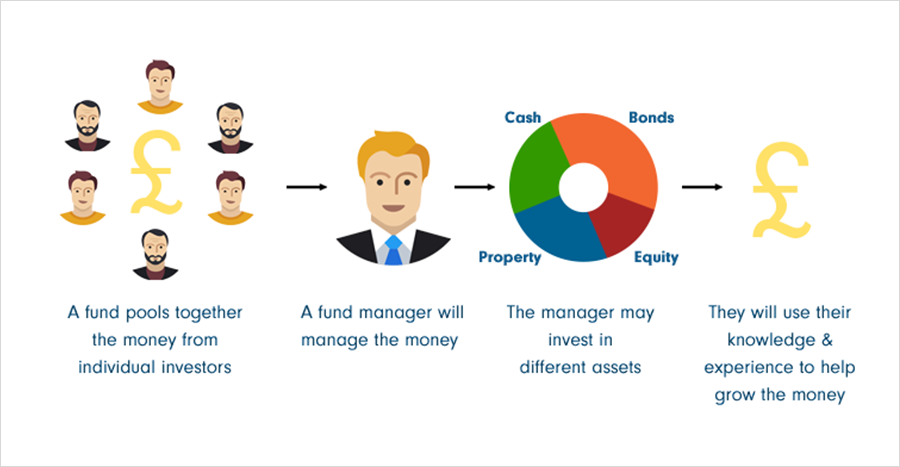

How mutual funds work

Important information - the value of investments can go down as well as up so you may get back less than you invest. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

What is a fund?

Funds allow investors to pool their money together, which a fund manager will then invest on their behalf. The manager is responsible for choosing investments for the fund and tries to grow investors’ money by spreading it over a range of company shares, bonds etc., although the growth isn't guaranteed.

Unit trusts, offshore funds and open-ended investment companies (OEICs) can all be referred to generically as funds.

Why invest in a fund?

More investment opportunities

Pool your money with other investors to take advantage of investment opportunities more easily than if you bought the individual assets yourself.

Managed by experts

Active fund managers use their knowledge, experience and research to help your money grow and provide you with an income, if required.

Spreading the risk

Invested across a number of different companies, you’re not relying too heavily on the fortunes of any one company.

Risks of investing in funds

However, there are a few things to consider, as well.

-

The value of funds can go down as well as up, so you may get back less than you invest -

Funds are medium to long-term investments; so you need need to be prepared to invest for at least five years -

Investing isn’t for everyone, and depends a lot on your personal circumstances and attitudes to risk

Fund types

These funds are open-ended funds, meaning they can get larger or smaller depending on the number of investors who wish to buy into them.

As more people invest in the fund, the number of underlying shares grows; as they sell, the number reduces.

While offshore funds are exempt from tax, meaning any gains can be reinvested back into the fund without being taxed, how much tax you pay depends on your circumstances, such as the country you live in at the time.

There are two types of property funds: ‘Bricks and mortar’ property funds, and property company funds, such as Real Estate Investment Trusts (REITs).

‘Bricks and mortar’ property funds invest in the buildings themselves. The fund takes responsibility for finding properties, handling the deals, seeking tenants and maintaining the buildings. You get a share of the rents paid by the property tenant, plus returns if the value of the properties owned by the fund increases.

While most property funds generally hold a cash buffer to meet short-term withdrawals, it may be difficult to redeem your investments at times of market stress. This is because the fund manager must sell physical property to meet redemptions, which may take time.

Property company funds invest in the shares of property companies. Global property funds can hold shares in Real Estate Investment Trusts (REITs), which are listed on the stock market and their fund price reflects the value of the properties they own.

Exchange traded funds are similar to the funds mentioned above except that they act like a share themselves, and are openly traded on a stock exchange such as the FTSE All Share. Most ETFs aim to perform in line with a specific index or commodity (like gold) and often have low management fees. Find out more about ETFs.

These are funds registered as public limited companies (PLCs) with their own management teams and boards of directors. They can invest in public and private companies, have a specific number of shares in issue and are traded on a stock exchange themselves. Find out more about investment trusts.

Fund management

Passively managed funds attempt to match or track the movement of a stock market index.

Your investment reflects proportionately the companies listed in a particular index, like the FTSE 100, and the stock market dictates how well your investment does.

Actively-managed funds invest in a collection of companies the fund manager feels can outperform the index. To identify these funds, they analyse company fundamentals, meet the management and work to maintain a balance of good companies that aims to perform better than the market average in various market conditions, but this is not guaranteed.

These funds don’t track the movement of a particular stock market index.

A fund of funds invests primarily in other investment funds rather than directly into individual companies.

They provide an alternative to putting together your own portfolio of funds, monitoring and making changes. They provide ready-made portfolios managed by expert fund managers.

Evaluating funds

- Age of the fund - Do you want a fund with an established track record, or get in early with a new fund launch?

- Size of fund - This indicates the fund’s popularity and past success at attracting investors. However, some funds can be so large it’s difficult for the fund manager to run it. A small fund is sometimes easier to manage.

- Fund manager tenure - Consistent fund performance often relies on a fund manager having managed it for some time. But watch out - star performers can change jobs.

- Independent ratings - Companies such as Morningstar, Standard & Poor’s and Moody’s provide independent ratings for funds’ performance, creditworthiness and consistency of management.

- Charges - Look closely at all the fund charges - are the ongoing charges excessive, are there penalties for withdrawing your money?

Differences between funds and other investments

-

May offer diversification depending on what it invests in -

Less risk than if you were to hold individual shares -

No transaction costs with funds on our platform

Related articles

Fundsmith Equity Fund: update from Terry Smith

The latest from the fund's well-known manager

Nick Sudbury

Investment writer

16 February 2026

4 income funds for your ISA

Tax efficient income ideas from the Select 50

Nick Sudbury

Investment writer

13 February 2026

4 growth funds for your ISA

Tax efficient growth ideas from the Select 50

Nick Sudbury

Investment writer

13 February 2026

Policies and important information

Accessibility | Conflicts of interest statement | Consumer Duty Target Market | Consumer Duty Value Assessment Statement | Cookie policy | Diversity, Equity & Inclusion | Diversity, Equity & Inclusion Reports | Doing Business with Fidelity | Investing in Fidelity funds | Legal information | Modern slavery | Mutual respect policy | Privacy statement | Remuneration policy | Staying secure | Statutory and Regulatory disclosures | Whistleblowing programme

Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. This website does not contain any personal recommendations for a particular course of action, service or product. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Before opening an account, please read the ‘Doing Business with Fidelity’ document which incorporates our client terms. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund.

This website is issued by Financial Administration Services Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) (FCA Register number 122169) and registered in England and Wales under company number 1629709 whose registered address is Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP.