Invest@Work with Fidelity and receive a special discount

Fidelity can help you save and invest for the future alongside your workplace pension. Invest@Work puts our Personal Investing service and tools right at your fingertips. Let us give you the information you need to feel confident making personal investment decisions.

Important information: please keep in mind that the value of investments can go down as well as up, so you may get back less than you invest.

Open an account or link to an existing one

Need a hand? Call our Invest@Work team weekdays, 8.30am - 5.30pm on 0800 268 0890 - they'll be happy to help.

Open an account

Set up your discount

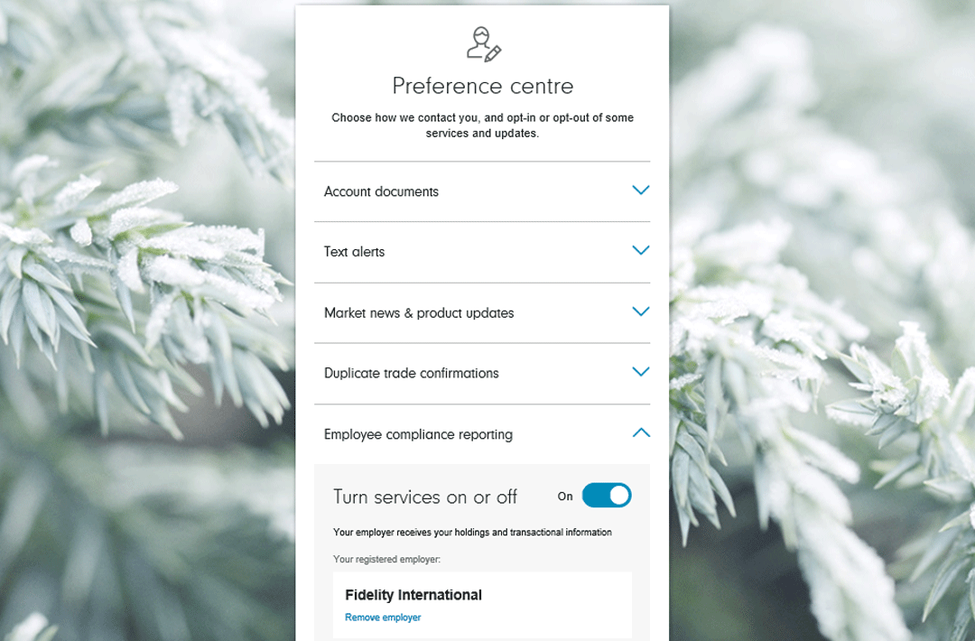

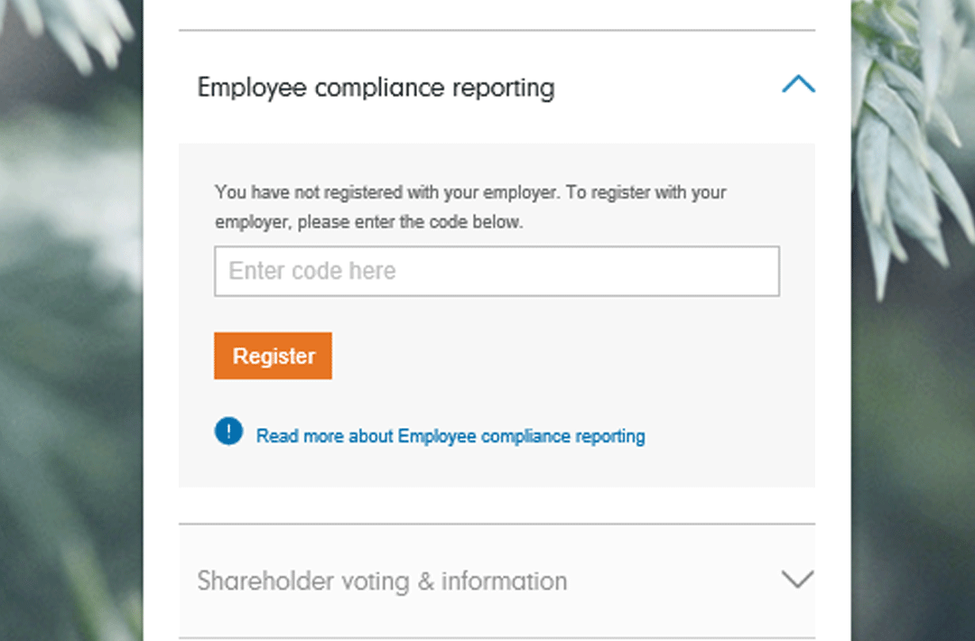

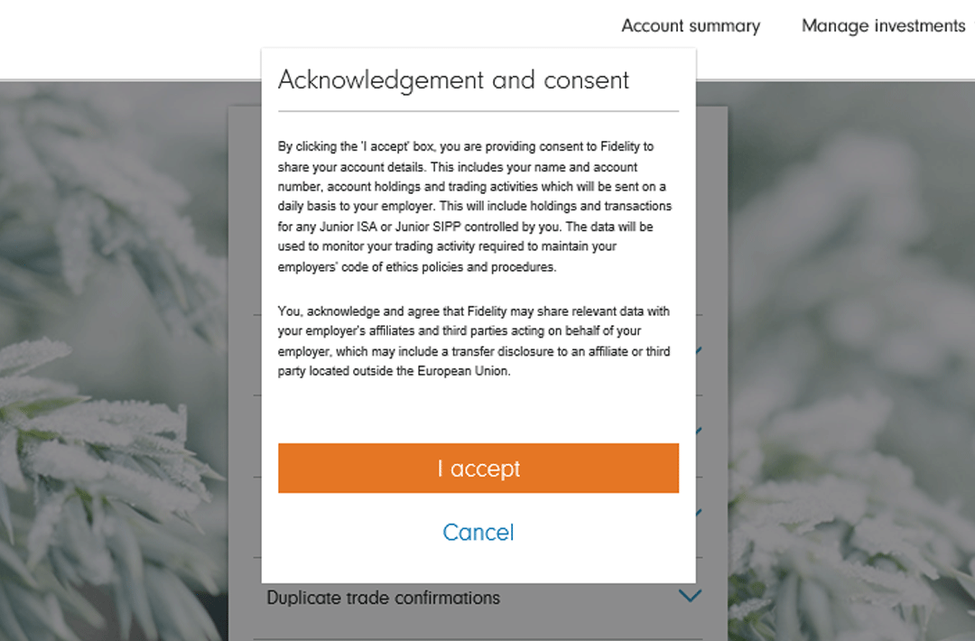

Employee compliance reporting

If you need to report details of your investments and your deals to your employer, we have an automatic service which does it all for you.

To get started, follow these steps:

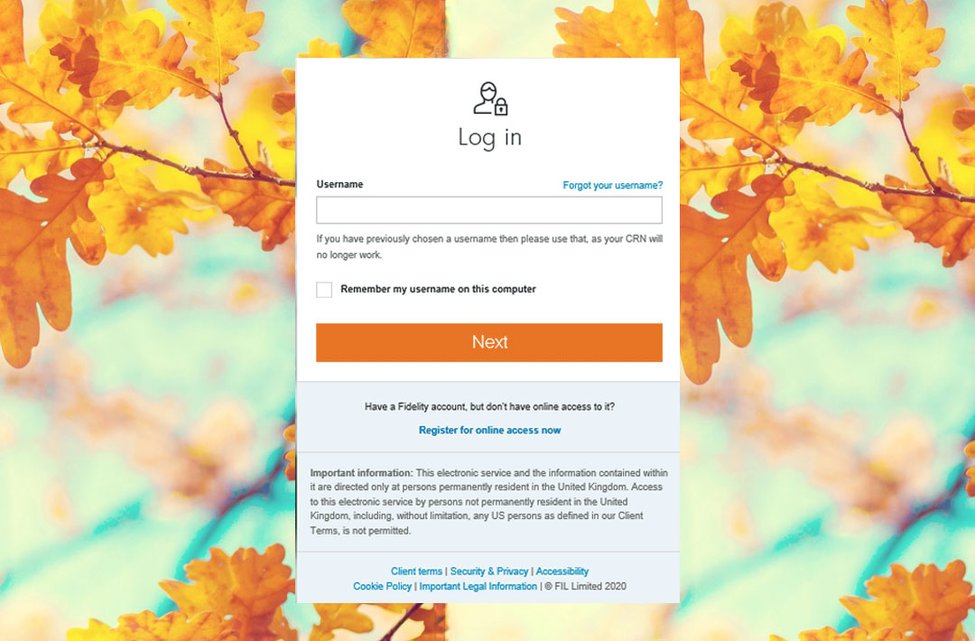

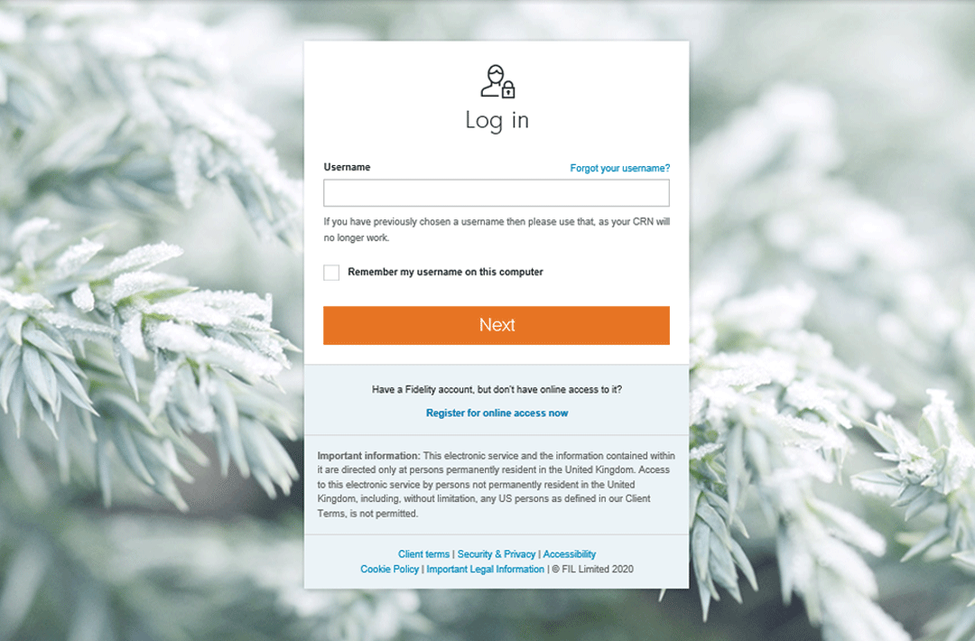

- Open an account (or log in if you already have one)

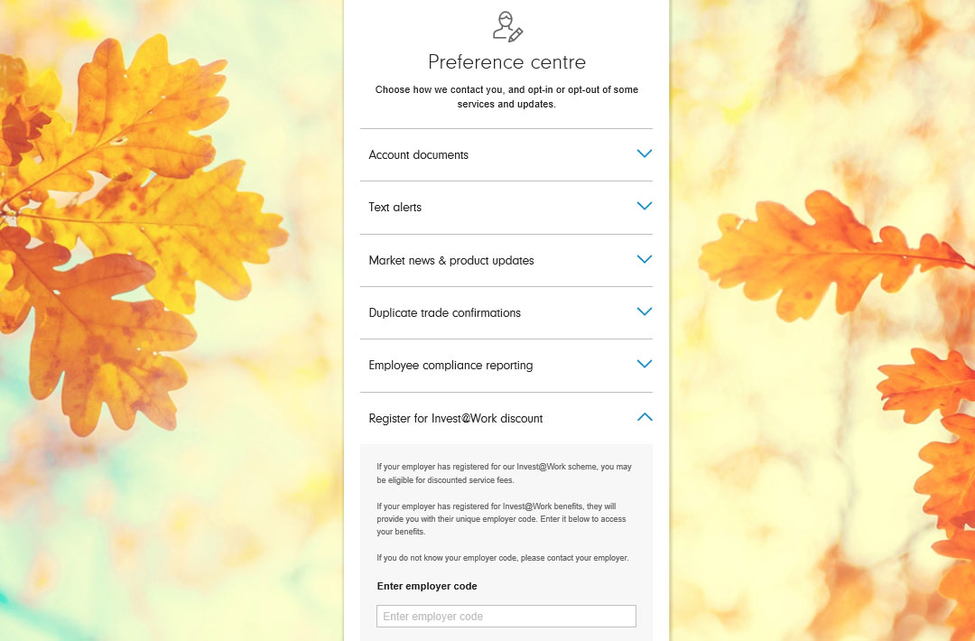

- Go to 'Employee compliance reporting' in the Preference Centre

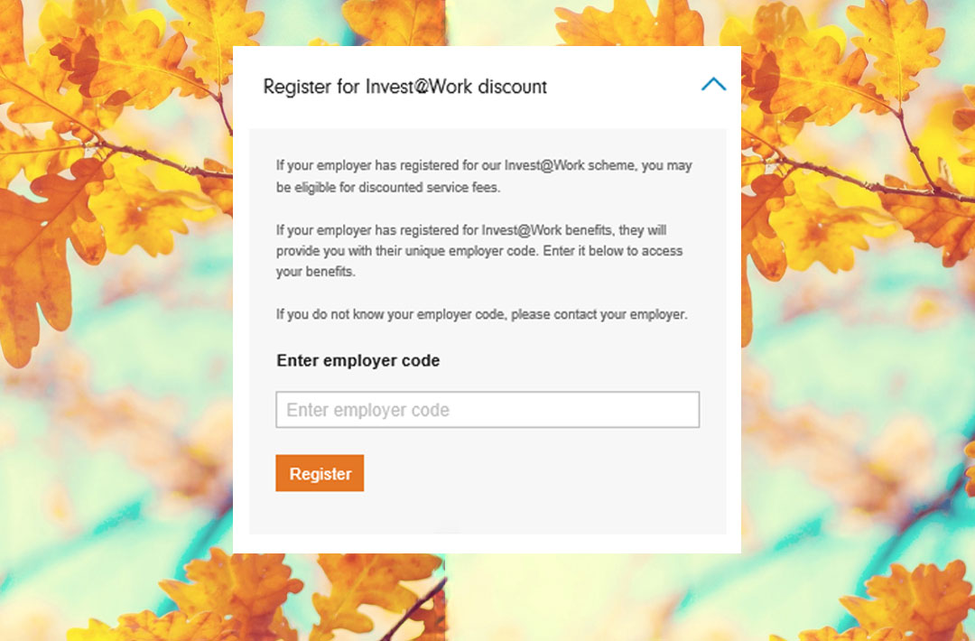

- Enter the code given to you by your employer

Your information will then be sent daily to your employer and include any new transactions or deals made that day.

Discounted service fees

Our service fee covers our secure, easy-to-use investing platform. This includes our tools, guidance, plus news and insights from industry experts.

Setting up compliance reporting through your employer will automatically apply a reduced 0.30% service fee (usually 0.35%). You can also benefit from a discounted 0.20% service if you hold more than £250,000 with us.

T&Cs apply.

See how to set up reporting

Discounted service fees

If you don't need to report details of your investments and your deals to your employer, you can still benefit from a reduced service fee.

Our service fee covers our secure, easy-to-use investing platform. This includes our tools, guidance, plus news and insights from industry experts.

Benefit from a discounted 0.20% service fee if you hold more than £250,000 with us. - T&Cs apply. Sign up with Invest@Work through your employer and we'll reduce our service fee to 0.30% (usually 0.35%).

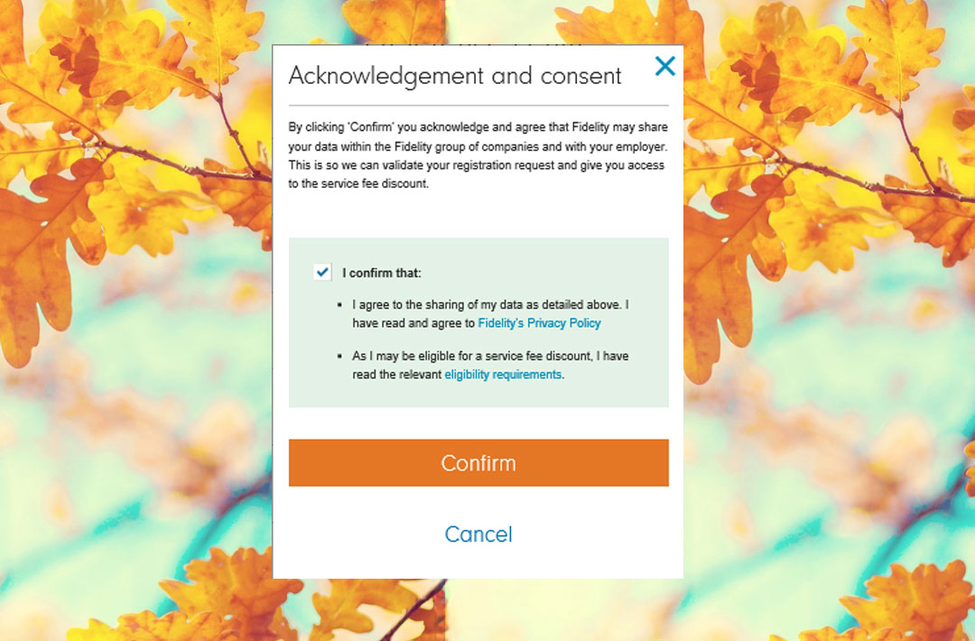

If you already have an account with Fidelity and don't need to report details of your investments and your deals to your employer, follow these instructions.

If you are required to preclear investments with your employer, please remember to contact them before instructing trades.

We’ve developed tools to help you explore your options and find the fund, or funds, that are right for you. Click on the play icon to watch our short video to learn more.

Risks and things to consider

- Investing in funds or the stock market opens the opportunity for making your money work harder, but the value of investments can go down as well as up, so you might get back less than you invest.

- Investing tends to work better over the longer term (through the ups and downs of markets) so investing for 5 years and over improves your chances of better returns, although this isn't guaranteed.

Important information: Eligibility to invest in an ISA or SIPP, and tax treatment depends on individual circumstances and tax rules may change. You cannot normally access money in a pension until age 55 (57 from 2028). Withdrawals from a Junior ISA are not possible until the child reaches age 18. This is not a personal recommendation for a specific investment. If you're not sure which investments are suitable for you, consult Fidelity's advisers or another authorised financial adviser.