Important information - the value of investments and the income from them, can go down as well as up, so you may get back less than you invest.

If you were asked to guess how much the global bonds market was worth… what would you put it at? A few hundred $billion? Well, according to the Securities Industry and Financial Markets Association (SIFMA) they've estimated the overall size of the global bond market to be approximately $140.7 trillion.1

It's no wonder we field so many questions about bonds. So, what are bonds? How do bonds work? And what role should bonds play in your portfolio?

I put a panel of wealth relationship managers (who offer 1-to-1 guidance to anyone who invests over £250k with us - which includes their pension) and advisers to the test. Here are their answers to customers’ 10 most-asked questions about bonds.

Read on or jump to the relevant question below.

- What are bonds?

- What are the different type of bonds?

- How do bonds work?

- What is the maturity of a bond and why does it matter?

- Do all bonds carry the same risk rating?

- Why should I hold bonds in my portfolio?

- How can I tell what my portfolio’s exposure to bonds is?

- Bonds and equities both fell in 2022. Could it happen again?

- What’s the outlook for bonds in 2025?

- How can I invest in a bond fund?

1. What are bonds?

Think of a bond as an IOU. When you buy a bond, you’re effectively loaning money to an organisation for a certain length of time. It’s a debt-based investment. At the end of the agreed fixed period, the bond will mature and repay the initial capital. In addition, along the way the borrower will pay interest to you.

2. What are the different types of bonds?

There are a number of variations, but the following are the largest categories.

Corporate bonds are issued by individual companies to finance their activities and investments.

Government bonds (also known as gilts in the UK or Treasuries in America) are issued by countries to fund public spending

3. How do bonds work?

To help you understand how bonds work, it’s important to understand what price, coupon, yield and value all mean.

The price is pretty self-explanatory. It’s what it costs you to buy the bond. The price of the bond will rise and fall over its ‘lifetime.’ It’s affected by all sorts of factors, including supply and demand, how close the bond is to maturity and credit quality as well as more macro influences like inflation, taxes and wages. Critically, bond prices are affected by interest rates. When interest rates increase, bond prices come down and vice versa. A bit like a seesaw.

The coupon is what the borrower pays you while you own the bond. It doesn't go up and down which is why bonds are referred to as a fixed-income asset class.

The yield goes up and down over the bond’s lifetime because it represents the relationship between the fixed coupon and the variable price of the bond (which goes up and down). This income is paid out at intervals, for example quarterly or annually.

The value of the bond is what you’ll receive when you sell it. If you sell it at maturity, you’ll get the same amount that you paid for it (the borrower is simply settling its IOU). If you want to sell the bond before it matures, its value (the price someone else will pay for it) is worked out by a mix of the value of the debt to be repaid, the interest it pays each year, the number of years until maturity and how risky the debt is.

4. What is the maturity of a bond and why does it matter?

Some bonds are short-dated and mature within five years, typically one to three years. As these carry less inflation and default risk, they usually receive lower interest (or yield/income). And some are long-dated bonds, more often used by governments, and mature upwards of ten years. These tend to receive higher interest.

Of course, there are no guarantees and sometimes the interest on short-dated bonds can be higher than on longer-dated bonds. This tends to happen when central banks are increasing interest rates aggressively and can be an indication of an economic slowdown or recession ahead. This situation is known as an ‘inverted yield curve’.

5. Do all bonds carry the same risk rating?

Generally speaking, bonds sit on the lower end of the risk/reward spectrum. However, not all bonds are the same. In fact, each bond carries its own bond rating. There are several global rating agencies which assess the credit worthiness of a company or government.

|

Rating |

Grade |

Risk |

|---|---|---|

|

AAA |

Investment |

Lowest risk |

|

AA |

Investment |

Low risk |

|

A |

Investment |

Low risk |

|

BBB |

Investment |

Medium Risk |

|

BB, B |

Junk |

High risk |

|

CCC/CC/C |

Junk |

Highest risk |

|

D |

Junk |

In default |

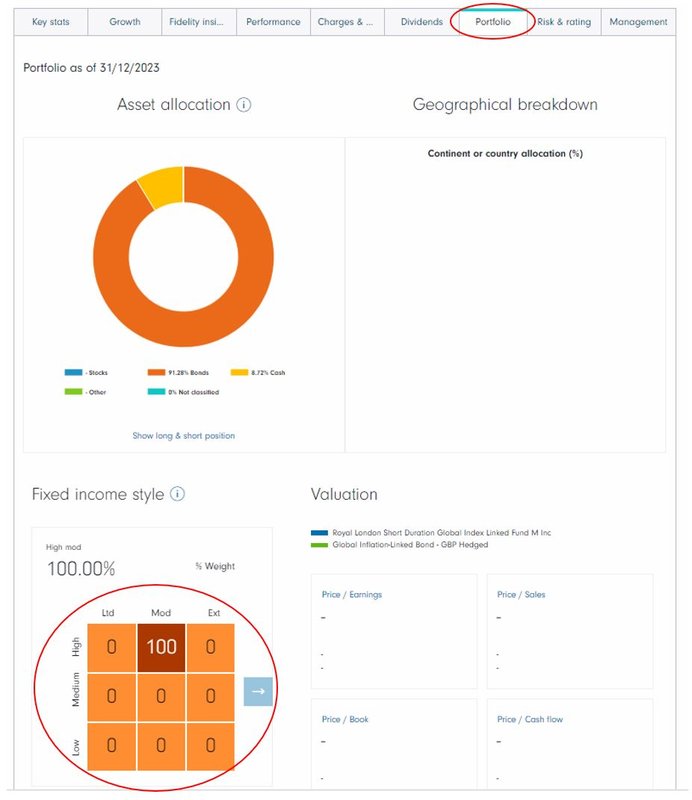

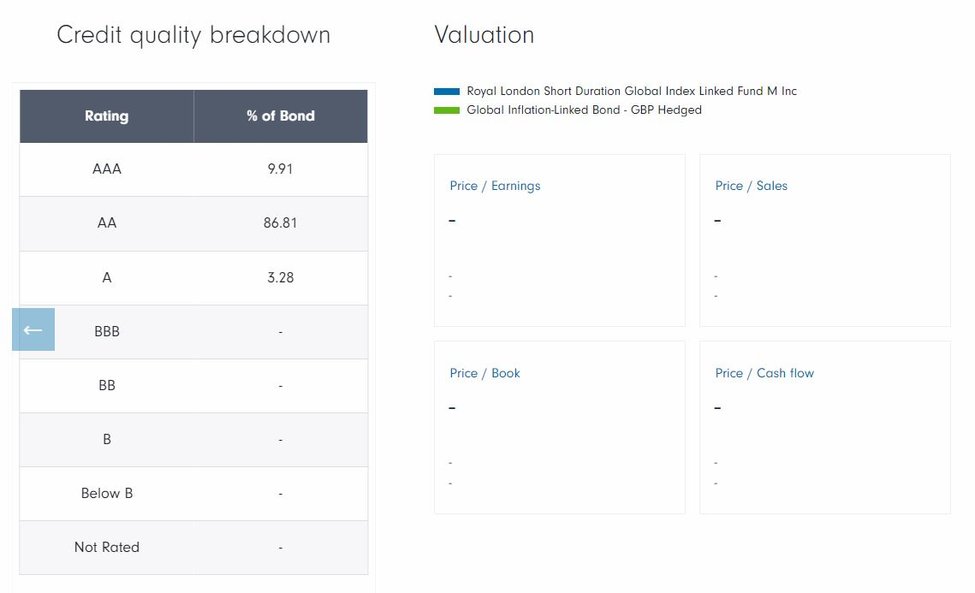

To find a bond’s rating, go to the fund information page of the bond you’re interested in on our website. Click on the portfolio tab and scroll to the ‘Fixed income style’ section.

Use the arrows to move the screen to the Credit quality breakdown. You can see the average credit quality rating (for example ‘AA’) on the ‘interest rate risk’ screen before you land on the credit quality breakdown.

6. Why should I hold bonds in my portfolio?

In performance terms, bonds may not have the rockstar appeal that equities - shares - might have. And yet, they do play a critical role in a diversified portfolio.

That’s because typically bonds and equities perform differently in the same economic conditions (note the use of the word ‘typically’ because that wasn’t the case in 2022, when they both had a bad year). So, they aim to balance each other.

7. How can I tell what my portfolio’s exposure to bonds is?

You can see exactly what you hold in your portfolio online. Log in to your account and click ‘see account holdings report’ on your account summary page. Next you need to select a benchmark to see how well your investments are doing compared to other market indices. You’ll then be able to see what percentage of bonds is in your portfolio under ‘asset allocation’. If you find the ‘Fixed Income’ section, you’ll also be able to view the effective maturity, duration and average credit quality of the bonds you’re invested in. It’s very worth doing and you might be surprised by what you find.

8. Bonds and equities both fell in 2022. Could it happen again?

It’s very rare for this happen. Asset classes such as bonds and equities tend to behave differently in the same economic conditions. It's therefore a good idea to hold a mix of different asset classes. That said, bonds and shares are more correlated than they have been over the last year or so. So, investors will want to think about a broader mix of investments (beyond the traditional 60% equities to 40% bonds ratio which has somewhat fallen out of experts' favour). Gold and property will have a role to play in a balanced portfolio. What the right mix looks like for you depends on your goals, timeframe and how comfortable you feel about risk.

9. What’s the outlook for bonds in 2025?

If you don’t get our Investment Outlook each quarter, it’s worth signing up for as it has our latest position on the major asset classes. You can sign up for the Investment Outlook here. Bonds were the poor cousin to equities in 2024 and Investment Director Tom Stevenson expects that to be the case for 2025 too. You can find out more about bonds from Tom in this short video.

10. How can I invest in a bond fund?

If you want some help choosing a bond fund, there are a number of ways to track one down that’s right for you.

If you’re looking for some support with making your decision, we have a number of bond funds in our Select 50 - a list of our favourite funds selected by experts (you can see these below).

Here’s a list of the bond funds on the Select 50.

- AXA Sterling Credit Short Duration Bond Fund

- Colchester Global Bond Fund GBP Unhedged

- iShares ESG screened Overseas Corporate Bond Index

- iShares Overseas Government Bond Index Fund (UK)

- JPM Global High Yield Bond Fund

- Legal & General Emerging Markets Government Bond Local Currency Index Fund

- M&G Corporate Bond Fund

- M&G Emerging Markets Bond Fund Sterling

- Royal London Short Duration Global Index Linked

- Vanguard Global Short-Term Bond Index Fund

Source:

Important information - investors should note that the views expressed may no longer be current and may have already been acted upon. There is a risk that the issuers of bonds may not be able to repay the money they have borrowed or make interest payments. When interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall. Due to the greater possibility of default an investment in a corporate bond is generally less secure than an investment in government bonds. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the fund investing in them. Overseas investments will be affected by movements in currency exchange rates. Investments in emerging markets can be more volatile than other more developed markets. Select 50 is not a personal recommendation to buy or sell a fund. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

Share this article

Latest articles

2026 fund picks: Dodge & Cox Worldwide Global Stock

Value-focused approach to international investing

Where next for the FTSE 100? Five charts to help you decide

UK’s most well-known index is hitting record highs