Invest@Work with Fidelity and receive a special discount

Fidelity can help you save and invest for the future. Invest@Work puts our Personal Investing service and tools right at your fingertips. We’re here to help you take control of your financial future, with expert insights and tools designed to build your confidence in making personal investment decisions.

Important information: please keep in mind that the value of investments can go down as well as up, so you may get back less than you invest.

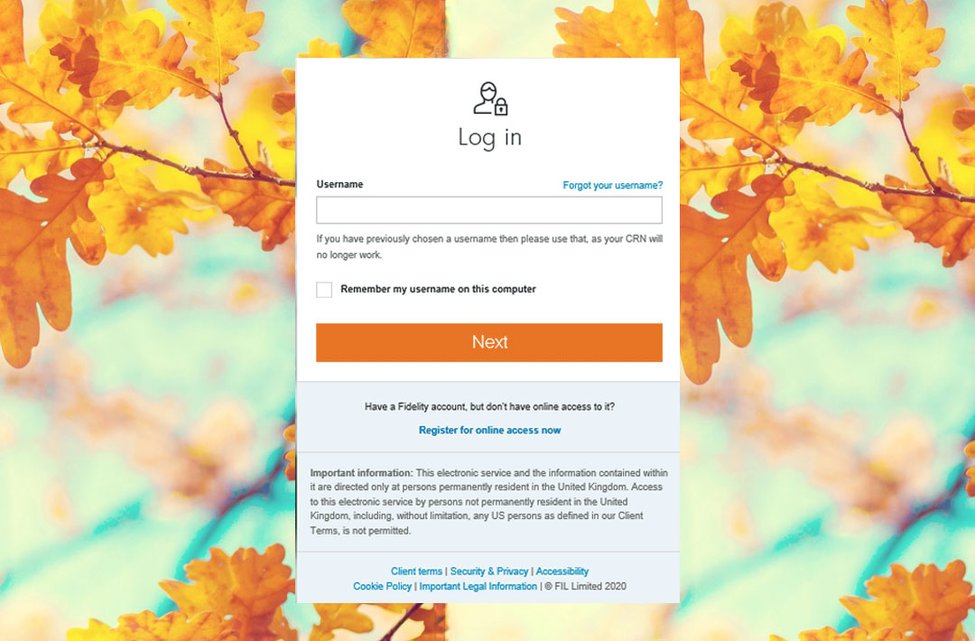

Open an account

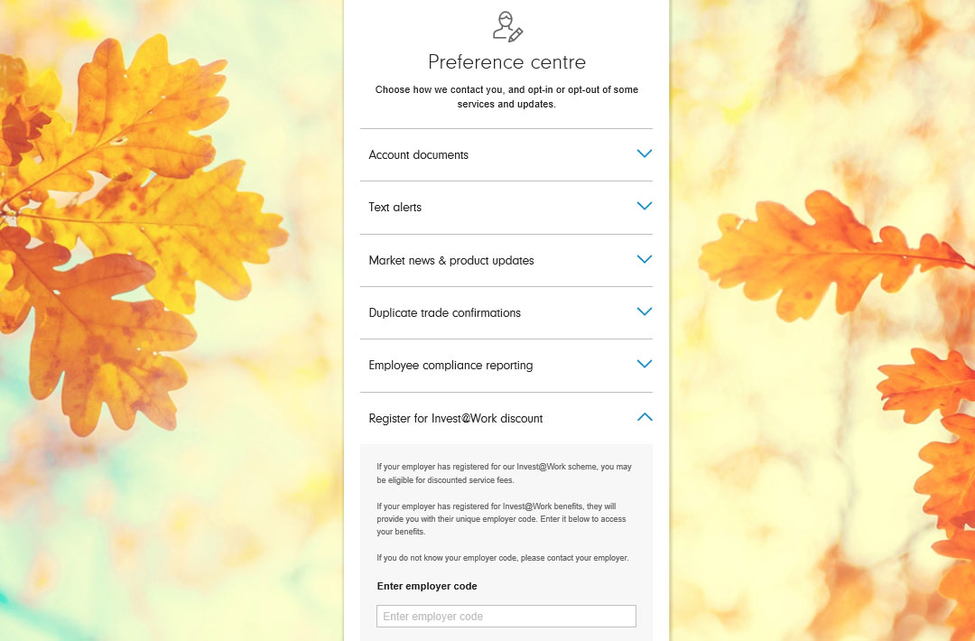

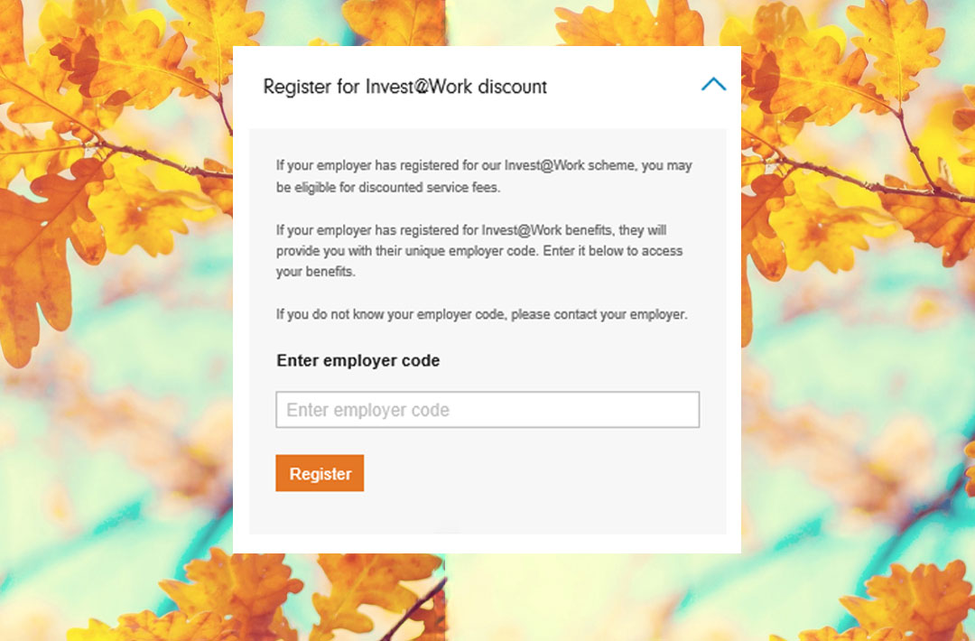

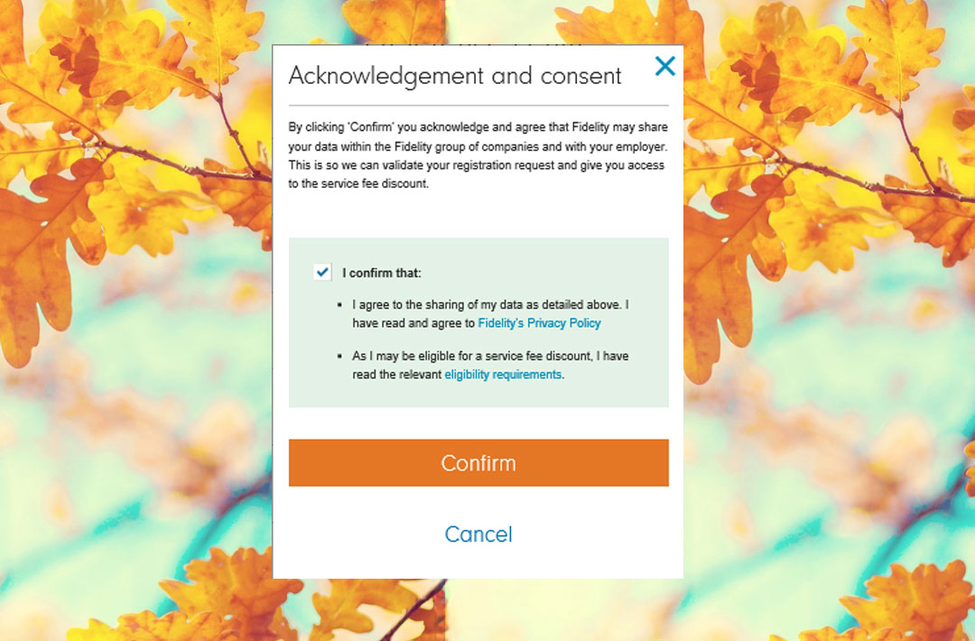

Set up your discount

Our service fee covers our secure, easy-to-use investing platform. This includes our tools, guidance, plus news and insights from industry experts.

Start saving with Invest@Work through your employer and we'll reduce our service fee to 0.30% (usually 0.35%). Please note, dealing and ongoing investment fees still apply.

We’ve developed tools to help you explore your options and find the investments that are right for you. Click on the play icon to watch our short video to learn more.

Risks and things to consider

- Investing in funds or the stock market opens the opportunity for making your money work harder, but the value of investments can go down as well as up, so you might get back less than you invest.

- Investing tends to work better over the longer term (through the ups and downs of markets) so investing for 5 years and over improves your chances of better returns, although this isn't guaranteed.

Important information: Eligibility to invest in an ISA or SIPP, and tax treatment depends on individual circumstances and tax rules may change. You cannot normally access money in a pension until age 55 (57 from 2028). Withdrawals from a Junior ISA are not possible until the child reaches age 18. This is not a personal recommendation for a specific investment. If you're not sure which investments are suitable for you, consult Fidelity's advisers or another authorised financial adviser.