Welcome to Invest@Work - feel confident about your finances

Fidelity can help you save and invest for the future alongside your workplace pension. You can choose to invest directly, and benefit from a discount on our service fee. Or, invest via payroll and we’ll reduce our service fee all the way to zero (0.0%). T&Cs apply. Dealing and ongoing investment fees still apply.

Jump to:

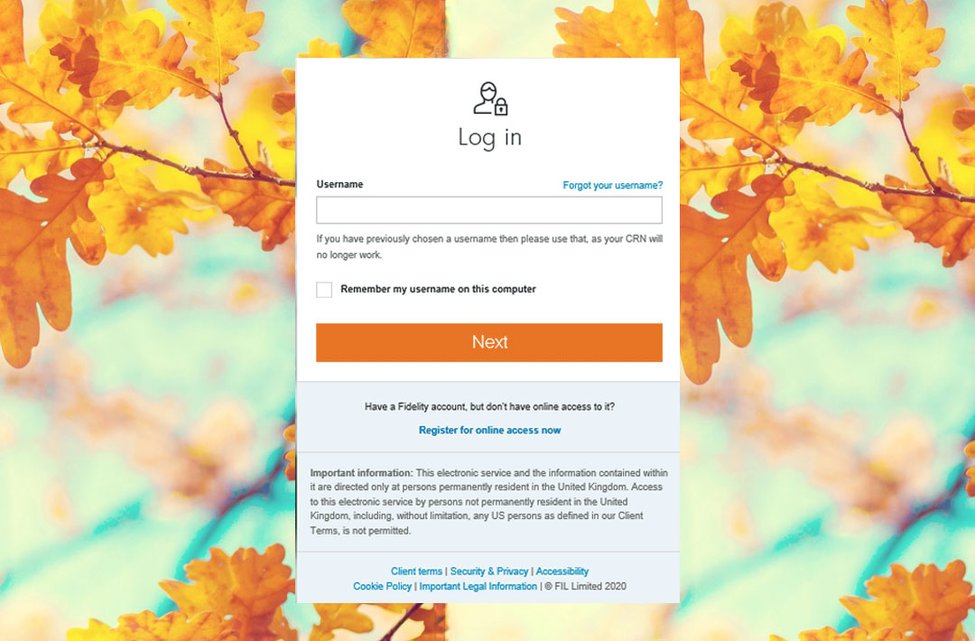

Open an account or link to an existing one

Our Invest@Work team is available to help you five days a week. You can call them on 0800 368 0890.

New to Fidelity Personal Investing

Already a Fidelity Personal Investing customer

Accounts available via payroll

- A tax-efficient way to hold a wide range of investments in a single account. Choose from mutual funds, exchange-traded funds (ETFs), investment trusts or individual stocks and shares. There is also the option to hold your money in cash temporarily until you decide where to invest it.

- Pay no tax on dividends, interest or capital gains.

- Take an income or make withdrawals whenever you want and it will all be tax free, though withdrawals will mean you lose that part of your £20,000 annual ISA allowance.

- Available to UK residents over the age of 18. US persons are unable to open an investment account with Fidelity International.

Our guide has more detail on how you can use a Stocks & Shares ISA to achieve your savings goals and how we can help you choose your investments.

- A tax-efficient way to save for a first home deposit or retirement, with the freedom to hold a wide range of investments in a single account. Choose from mutual funds, exchange-traded funds (ETFs), investment trusts or individual stocks and shares. There is also the option to hold your money in cash temporarily until you decide where to invest it.

- The government adds £1 for every £4 you invest, up to the annual allowance, plus there is no tax on dividends, interest or capital gains.

- You can only contribute to one Lifetime ISA each tax year and the annual allowance is £4,000. (Any Lifetime ISA contributions also count towards your £20,000 ISA annual allowance).

- You can take your money out, penalty free, from the age of 60 (or earlier if you are critically ill) or to buy a first home. You can also take tax-free income from the age of 60. Any other withdrawals or income will have a 25% charge from the government.

- Open to people resident in the UK over the age of 18 and under the age of 40. There is then the option of continuing to make contributions once the account is open until the age of 50. US persons are unable to open an investment account with Fidelity International.

Our guide has more detail on how you can invest in a Lifetime ISA to buy your first home and how we can help you choose your investments.

- Hold a wide range of investments in a single account. Choose from mutual funds, exchange-traded funds (ETFs), investment trusts or individual stocks and shares. There is also the option to hold your money in cash temporarily until you decide where to invest it.

- There are no direct tax benefits. Unlike an ISA or pension, investments in this account are not held in a tax wrapper. Depending on your personal circumstances you may need to pay income tax or capital gains tax if you exceed your personal allowances.

- You can invest as much as you want each year and open as many accounts as you want.

- Take an income or make withdrawals whenever you want.

- Available to UK residents over the age of 18. US persons are unable to open an investment account with Fidelity International.

Our guide explains the flexible benefits of an Investment Account and how we can help you choose your investments.

Our service fee covers our secure, easy-to-use investing platform. This includes our tools, guidance, plus news and insights from industry experts.

If you sign up to Invest@Work via payroll, we’ll discount our service fee all the way to zero (typically 0.35%, but you’ll pay 0.0%). Or, if you’d prefer, you can invest directly with us, and get a discount on the usual service fee - reducing it to 0.30%. Please note, dealing and ongoing investment fees still apply.

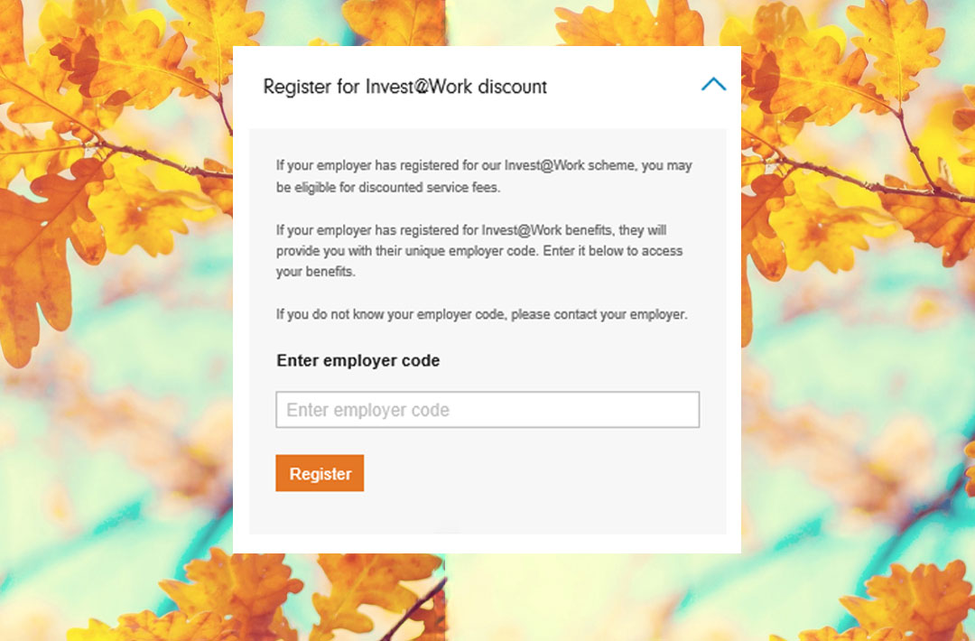

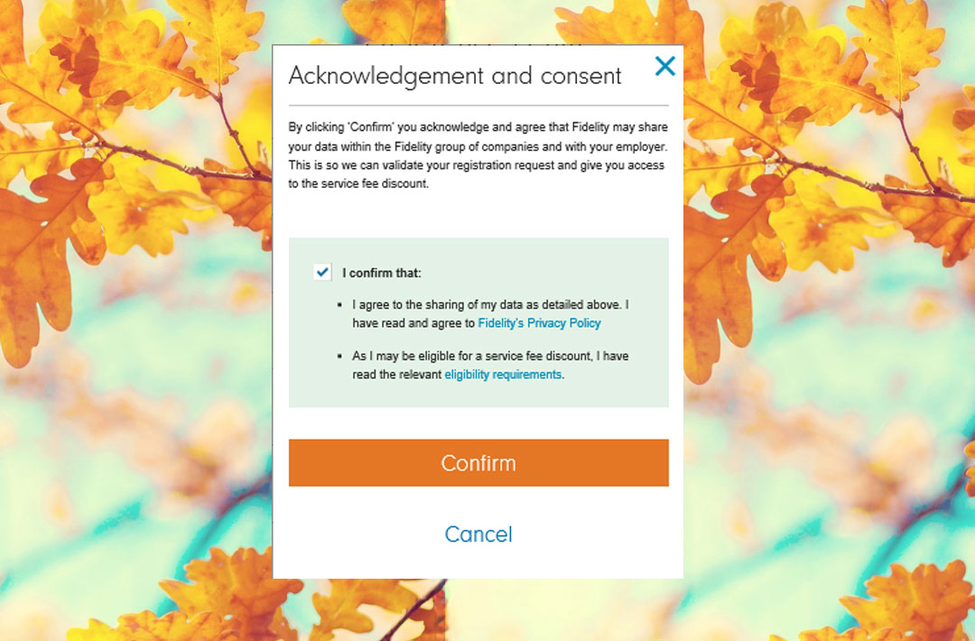

When you invest via payroll, the service fee discount (0%) will automatically be applied. Click here to see how to set up the discount if you would like to invest with us directly instead.

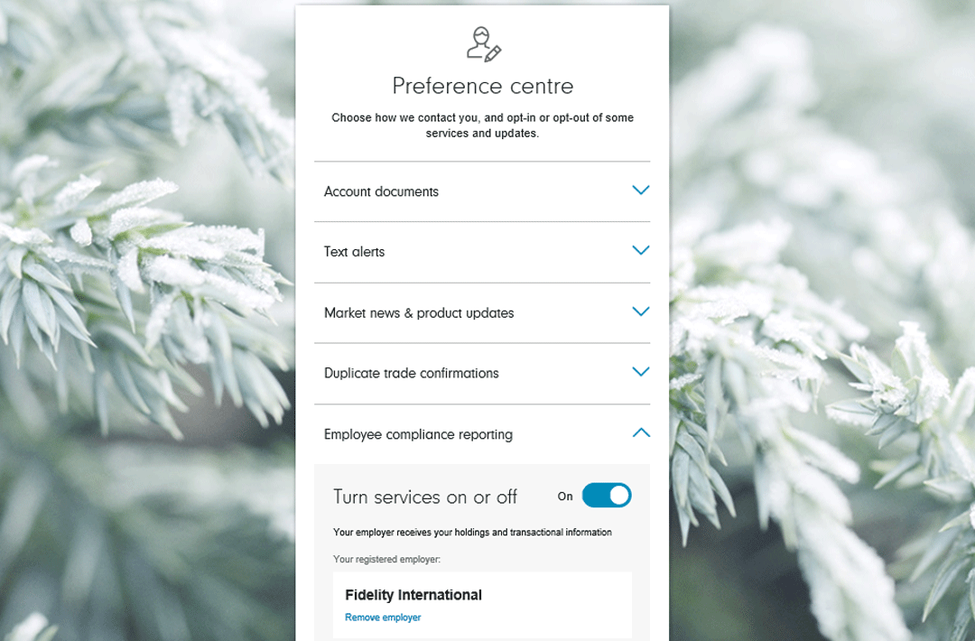

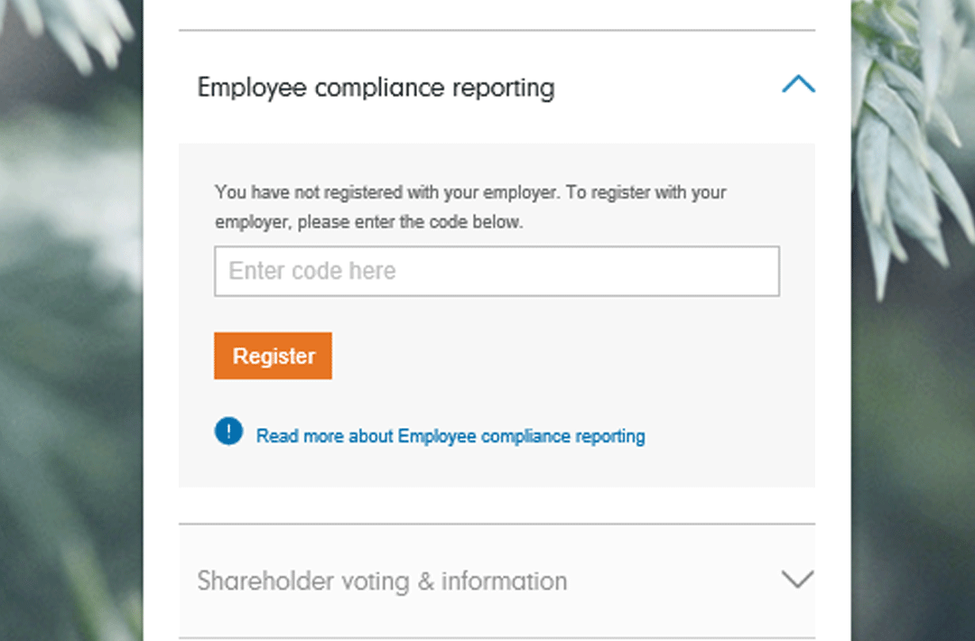

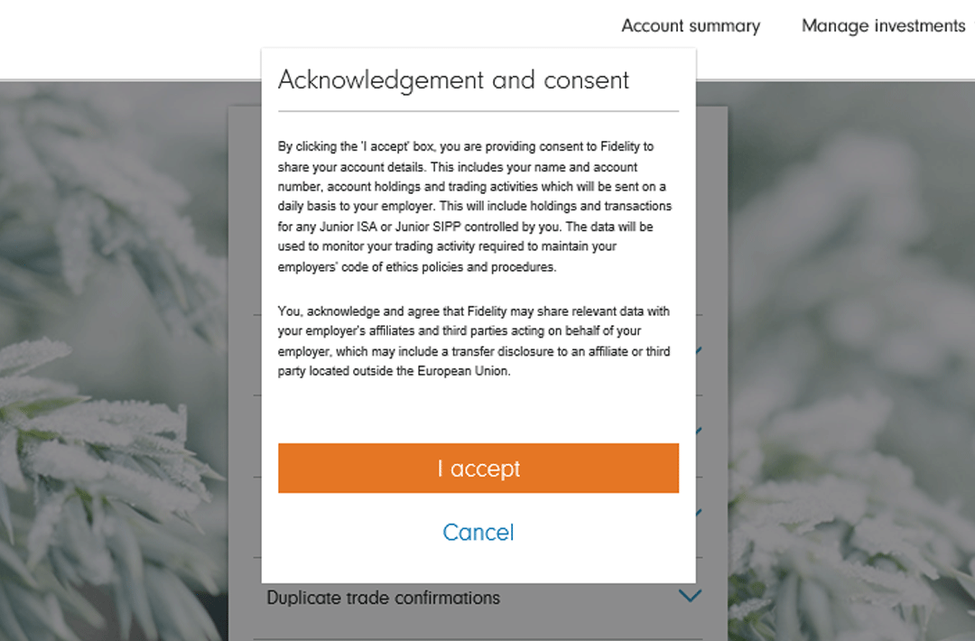

If you need to report details of your investments and your deals to your employer, we offer an automatic service which does it all for you.

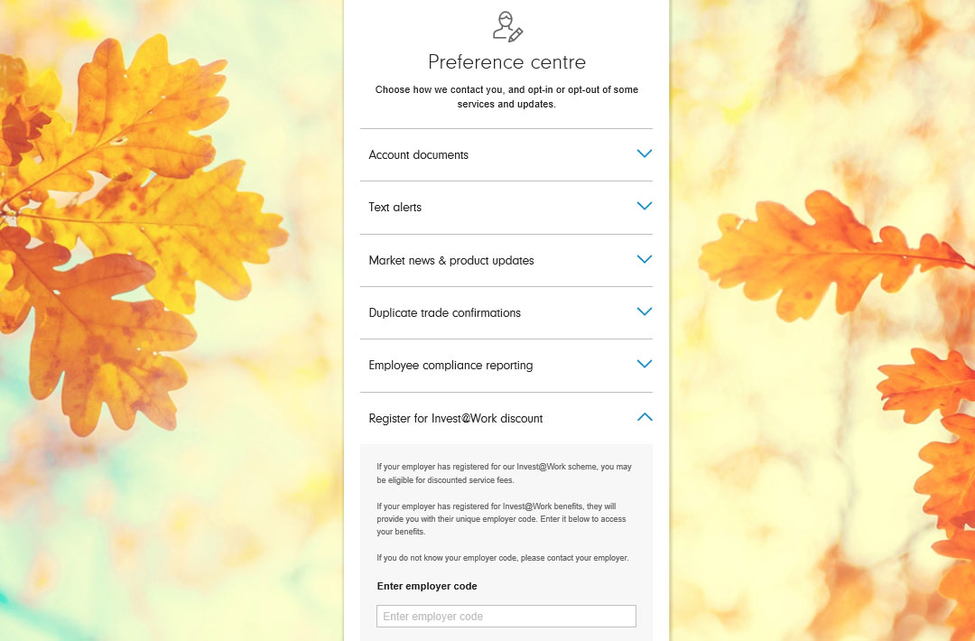

All you need to do is open an account (or log in if you already have one) go to 'Employee compliance reporting' in the preference centre and enter the code given to you by your employer.

Your information will then be sent daily to your employer and include any new transactions or deals made that day.

If you are investing directly from your bank account, when you set up employee compliance reporting the discounted rate of 0.30% will automatically be applied. If you invest via payroll, the 0.0% discounted rate will automatically be applied when you set up your account, and you will need to set up employee compliance reporting separately if applicable.

What we offer

Whether you’re looking for a few investment ideas, or want to browse the full suite of everything we offer, we can help you get started.

Risks and things to consider

- Investing in funds or the stock market opens the opportunity for making your money work harder, but the value of investments can go down as well as up, so you might get back less than you invest.

- Investing tends to work better over the longer term (through the ups and downs of markets) so investing for 5 years and over improves your chances of better returns, although this isn't guaranteed.

Frequently asked questions

To invest from your salary you’ll need your personal details to hand (including your National Insurance number), as well as your employer reference number (This is a 10 digit number starting with 100) and your staff number (your personal number, unique to you as an employee).

If you don’t want to invest from your salary, you will need your employer code to register for the discount. This will be four letters followed by 01, e.g. ABCD01.

The employer reference number/employer code will help us link your account to your employer and can be found on your employer’s benefits portal or from communications from your employer.

For more information, please contact your employer representative.

Yes, providing you are 18 years or over, a resident in the UK and not a US Person.

Crown Servants employed overseas (for example members of the armed forces), and anyone married to or in a civil partnership with a Crown Servant are eligible to open accounts as if they were resident in the UK.

You can pay from your salary into a Stocks & Shares ISA, Lifetime ISA or an Investment Account. If you don’t invest from your salary you can’t open a Lifetime ISA, but you can open a Stocks and Shares ISA or an Investment Account, as well as a Self-Invested Personal Pension (SIPP), Junior ISA or Junior SIPP.

If you need further help, please call our dedicated Invest@Work number on 0800 368 0890.

Our lines are open Monday - Friday: 8:30am - 5:30pm.

- Invest via payroll and we’ll reduce our service fee all the way to zero (typically 0.35%, but you’ll pay 0%)

- Invest directly with us and benefit from our discounted service fee of 0.30%

- We don’t charge for fund dealing, although some investment companies may have a buy/sell charge

- For shares, exchange-traded funds and investment trusts we charge £1.50 for deals as part of a regular savings plan, for one-off deals we charge £7.50 online or £30 over the phone.

- There will be investment charges set by the companies and funds you invest into. Ongoing fund charges start from 0.05%

Important information - Eligibility to invest in a Lifetime ISA, ISA or SIPP, and tax treatment depends on individual circumstances and all tax rules may change in the future. You cannot normally access money within a Lifetime ISA unless you are buying your first home, or from age 60. Other withdrawals may incur a 25% government withdrawal charge, so you may get back less than you put in. A Lifetime ISA is not a replacement for a workplace pension. If you save into a Lifetime ISA instead of enrolling into or contributing to a workplace pension, you could lose the benefit of employer contributions. The value of your Lifetime ISA could affect any current or future entitlement to means tested benefits. You can't normally access money in a pension until age 55 (57 from 2028). This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser.