Investment accounts

Adult accounts

Child accounts

Choosing Fidelity

Choosing Fidelity

Why invest with us Current offers Fees and charges Open an account Transfer investments

Financial advice & support

Fidelity’s Services

Fidelity’s Services

Financial advice Retirement Wealth Management Investor Centre (London) Bereavement

Guidance and tools

Guidance and tools

Choosing investments Choosing accounts ISA calculator Retirement calculators

Share dealing

Choose your shares

Tools and information

Tools and information

Share prices and markets Chart and compare shares Stock market news Shareholder perks IPOs and placings

Pensions & retirement

Pensions, tax & tools

Saving for retirement

Approaching / In retirement

Approaching / In retirement

Speak to a specialist Creating a retirement plan Taking tax-free cash Pension drawdown Annuities Investing in retirement Investment Pathways

In this section

Saving for retirement in your 20s and 30s

Important information - the value of investments can go down as well as up so you may not get back what you invest. Eligibility to invest in a SIPP and tax treatment depends on personal circumstances and all tax rules may change in the future. You cannot normally access money in a SIPP until age 55 (57 from 2028).

In your 20s and 30s you’ve probably got so many priorities competing for your attention that retirement may be the last thing on your mind; it may feel so far away that you can think about it later. But, if you start saving for retirement now (with even a moderate amount), you have one great advantage over those who start later.

Time is on your side

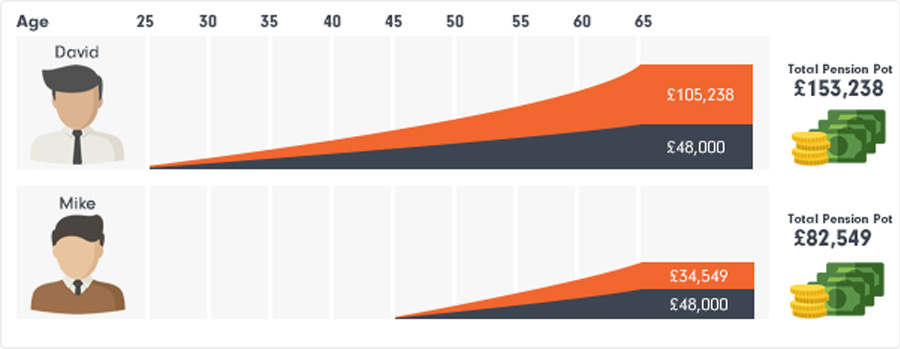

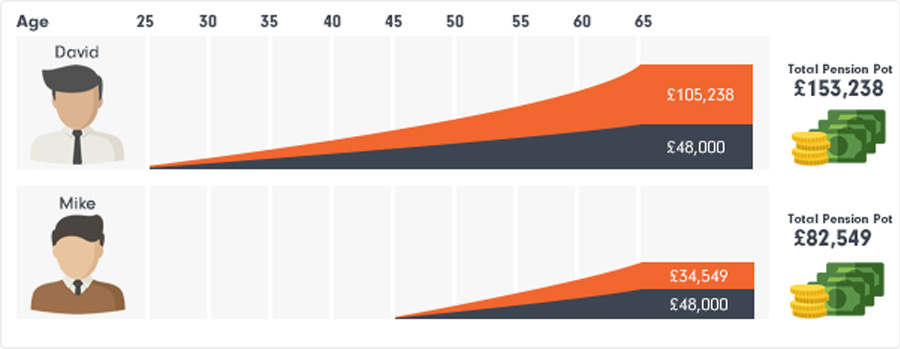

The images below show just how much difference it could make when you start saving and investing early - the length of time you invest for is the single biggest factor that determines growth opportunity - the longer, the better, although of course there are no guarantees.

In our hypothetical example, David starts investing £100 a month when he is 25; Mike invests £200 a month from the age of 45, so they both save the same £48,000 by age 65 and reinvest the returns. Assuming a 5% annual return, the effect of growth, reinvestment and compounding have longer to work on David’s investments, and so he ends up with almost twice as much as Mike.

Reasons to start now

Tax relief boost - for every £80 saved, the government provides £20 in tax relief, and you may get more back in your tax return if you pay tax at a higher rate.

Longer retirements - If you’re in your 20s or 30s, you’re likely to spend 20 years in retirement - or even longer.

What you can do now

Maximise your employer contributions

If your employer offers a workplace pension, then you should consider contributing whatever is required to get the maximum employer contribution.

Set up a regular savings plan

If you are self-employed or simply want to pay more into your pension, then you can pay in and get tax relief on anything up to the annual limit of £60,000* or to 100% of your earnings if that’s lower.

Regularly review your payments

As your circumstances change, you can easily increase, stop or restart your contributions any time to suit you.

Keep pace with your salary increases

Any time you get a pay rise, think about increasing your pension contributions by the same percentage.

Bring your pensions together

As you’re likely to have a number of jobs, you could easily end up with a dozen or more pensions by the time you retire. Tracking multiple pensions through multiple providers is tricky and time consuming, it might be easier in the long run to bring them together as you go.

If you have savings in several pensions – which is likely if you change jobs during your career – then bringing them together means you have just one company to deal with for every aspect of your income. Just be sure that if you transfer your pensions to one company, you check what charges apply and that you have access to all the income options you need.

Important information - It’s important to understand that pension transfers are a complex area and may not be suitable for everyone. Before going ahead with a pension transfer, we strongly recommend that you undertake a full comparison of the benefits, charges and features offered. To find out what else you should consider before transferring, please read our transfer factsheet. If you are in any doubt whether or not a pension transfer is suitable for your circumstances we strongly recommend that you speak to a Fidelity adviser or an authorised financial adviser of your choice.

Choose the right investments for you

When it comes to choosing which investments to include in your SIPP, we’ve plenty of online tools and guidance to help you decide. We’ve also got a range of investment guides and videos to help you make the most of your money.

An essential guide to saving for retirement

Did you know a single person will need about £41,300* a year for a comfortable retirement? With the new State Pension paying a maximum of £11,502.40 per year from April 2024, there’s clearly a gap.

Our guide provides you all the information you need to make sure you’re ready for the future you want.

Source: Pension and Lifetime Savings Association - UK Retirement Living Standards in 2023.

What next?

If you want to open a new pension or transfer an existing pension to Fidelity, then take a look at our Self-Invested Personal Pension (SIPP). It’s a flexible, tax-efficient and easy-to-manage pension designed to help you to reach your pension goals.

Open a pension

- A tax-efficient way to invest for your retirement (subject to limits)*

- Benefit from 20% government tax relief, added to your SIPP account

- If you pay Income Tax at higher than the basic rate, you may be able to claim even more tax relief through your tax return

- Employers can also contribute. Payments from a limited company are considered employer contributions

Transfer a pension

- Transfer your pension to us and we’ll pay any exit fee (up to £500 per person, T&Cs apply**) that your current provider charges you

- It’s easy to submit your request online, and depending on your current pension provider your transfer could be complete in ten business days.

- We’ll contact your providers and arrange for your investments (or cash) to be brought into your Fidelity account

- If you apply to transfer a SIPP through our website, you can track your transfer's progress using our transfer tracking tool.

*Tax relief is only available on the lower of the annual allowance (currently £60,000) or 100% of your earnings in a given tax year (or to £3,600 if you have no earnings). If you exceed your annual allowance you may have a tax charge to pay unless you have unused allowance you can carry forward. If you have earnings of £260,000 or more, the amount you can pay in and receive tax relief on could be ' tapered' down to £10,000. Alternatively, if you’ve already taken taxable income from your pension pot, your annual allowance may be £10,000 (known as the money purchase annual allowance) and you will not be able to use carry forward to contribute to a SIPP.

For more information on tax relief and all the allowances please visit our pension allowances page.

Important information - It’s important to understand that pension transfers are a complex area and may not be suitable for everyone. Before going ahead with a pension transfer, we strongly recommend that you undertake a full comparison of the benefits, charges and features offered. To find out what else you should consider before transferring, please read our transfer factsheet. If you are in any doubt whether or not a pension transfer is suitable for your circumstances we strongly recommend that you speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

Already have a SIPP with us?

It’s easy to increase your contributions in line with your changing circumstances. Of course you can decrease them too if you need to, but it’s a good idea to take advantage of the tax relief. You can view your SIPP account online and change the amounts you pay in through your regular savings plan.

Log in to view your accountRemember, you can access your pension at 55 (57 from 2028)

One key benefit of a pension is that you can access your pension at 55 (57 from 2028) so you aren’t tempted to dip in and out until you’re eligible to take your benefits. However, if you want access to your money sooner, there are other account options, such as an ISA, that may be more suitable.

Find out about our ISARelated articles

7 steps to ‘permanently’ fix your finances

A framework for financial success

Gemma Evangelou

Wealth Adviser, Fidelity International

24 April 2024

7 ‘dividend hero’ investment trusts

Investment trust income ideas

Richard Evans

Fidelity International

10 April 2024

What funds have investors been buying this year?

The most popular funds with our investors this year

Graham Smith

Investment writer

05 April 2024

Important information: This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment please speak to one of Fidelity’s advisers or an authorised financial adviser of your choice.

Exit fees terms and conditions

In order to request exit fees re-imbursement you will be required to complete an exit fees re-imbursement form which you can download here, or request over the phone by calling us on 0333 300 3351.

Terms and conditions for re-imbursement of exit fees

Fidelity will reimburse the exit/redemption fees charged to a customer by their former provider/s when they move their investments (minimum of £1,000) to Fidelity, up to a maximum amount of £500 per customer.

An exit fee is an administration charge which is imposed by the former provider and arises directly as a result of processing the transfer or re-registration of the customer’s investments to Fidelity. Fidelity will not reimburse the customer for any loss of investment returns, loss of interest, dealing charges, penalties for transferring investments before their maturity dates or any other charges associated with your transfer or re-registration.

Where a re-registration or transfer is not possible and the customer chooses to sell their investments held through another provider and subsequently make new investment/s (minimum £10,000) through Fidelity, Fidelity will cover any account closure fees charged by the customer’s former provider (excluding any dealing charges) of up to £500 per customer. Fidelity will not cover any bid-offer spreads or any capital gains tax liability arising as a result of these transactions.

Exit and account closure fees reimbursement must be claimed within a 6 month period from date of transfer of the customer’s investments to Fidelity. Exit fees will be reimbursed for transfers and re-registrations and account closure fees will be reimbursed provided the conditions above are met. Products included: ISAs, PEPs, Unit Trusts, OEICs, SICAVs, Fidelity Personal Pension, EBS SIPP and the Fidelity SIPP. Products excluded: ShareNetwork.

To qualify for the reimbursement, the fees from the customer’s former provider must have been triggered as a direct result of the transfer or re-registration to Fidelity, or the closure of an account where the customer has subsequently (within 6 months) invested at least £10,000 through Fidelity. If the customer is transferring investments to more than one provider from their former provider at the same time, Fidelity will only reimburse the fees which are incurred as a result of direct transfer or re-registration to Fidelity. Other fees or charges unconnected with the transfer will not be reimbursed.

The completed Exit Fee Reimbursement Form and documentary evidence of the charge will need to be provided in order for the exit fees to be reimbursed to the customer. To claim the reimbursement of any account closure fees, documentary evidence of the closure fee levied will need to be provided to Fidelity, along with confirmation that a minimum of £10,000 has been invested with Fidelity within 6 months of incurring such closure fee.

The documentary evidence referred to above, must be either a copy of the charge confirmation letter from the former provider or a statement showing the charge being deducted.

Payment will be made to the customer by BACS when a bank mandate is held on the account. Alternatively, payment will be made by cheque.

Open my SIPP

Open SIPP

You will need:

- Your National Insurance number

- Debit card details (for a single payment)

- Bank or building society details (if you’re planning on setting up a regular savings plan)

- Your annual allowance (if you are over 55)

Existing customer

If you already have a Fidelity account, log in here to open your SIPP.

New customer

If you're new to Fidelity, you can open your account here.

Exit fees terms and conditions

In order to request exit fees re-imbursement you will be required to complete an exit fees re-imbursement form which you can download by clicking here, or request over the phone by calling us on 0333 300 3351.

Terms and conditions for re-imbursement of exit fees

This offer does not apply to any investments linked to an Adviser / Intermediary or third party.

Fidelity will reimburse the exit/redemption fees charged to a customer by their former provider/s when they move their investments (minimum of £100) to Fidelity Personal Investing, up to a maximum amount of £500 per customer.

An exit fee is an administration charge which is imposed by the former provider and arises directly as a result of processing the transfer or re-registration of the customer’s investments to Fidelity. Fidelity will not reimburse the customer for any loss of investment returns, loss of interest, dealing charges, penalties for transferring investments before their maturity dates or any other charges associated with your transfer or re-registration.

Where a re-registration or transfer is not possible and the customer chooses to sell their investments held through another provider and subsequently make new investment/s (minimum £10,000) through Fidelity Personal Investing, Fidelity will cover any account closure fees charged by the customer’s former provider (excluding any dealing charges) of up to £500 per customer. Fidelity will not cover any bid-offer spreads or any capital gains tax liability arising as a result of these transactions.

Exit and account closure fees reimbursement must be claimed within a 6 month period from date of transfer of the customer’s investments to Fidelity. Exit fees will be reimbursed for transfers and re-registrations and account closure fees will be reimbursed provided the conditions above are met. Products included: ISAs, Investment Accounts, EBS SIPP, Fidelity Personal Pension, Fidelity SIPP, Unit Trusts, OEICs, SICAVs, Exchange Traded Funds, Investment Trusts and Shares.

To qualify for the reimbursement, the fees from the customer’s former provider must have been triggered as a direct result of the transfer or re-registration to Fidelity Personal Investing, or the closure of an account where the customer has subsequently (within 6 months) invested at least £10,000 through Fidelity Personal Investing. If the customer is transferring investments to more than one provider from their former provider at the same time, Fidelity will only reimburse the fees which are incurred as a result of direct transfer or re-registration to Fidelity. Other fees or charges unconnected with the transfer will not be reimbursed.

The completed Exit Fee Reimbursement Form and documentary evidence of the charge will need to be provided in order for the exit fees to be reimbursed to the customer. To claim the reimbursement of any account closure fees, documentary evidence of the closure fee levied will need to be provided to Fidelity, along with confirmation that a minimum of £10,000 has been invested with Fidelity within 6 months of incurring such closure fee.

The documentary evidence referred to above, must be either a copy of the charge confirmation letter from the former provider or a statement showing the charge being deducted.

Payment will be made to the customer by BACS when a bank mandate is held on the account. Alternatively, payment will be made by cheque.

Policies and important information

Accessibility | Conflicts of interest statement | Consumer Duty Target Market | Consumer Duty Value Assessment Statement | Cookie policy | Diversity and Inclusion | Doing Business with Fidelity | Fidelity gender pay report | Investing in Fidelity funds | Legal information | Modern slavery | Mutual respect policy | Privacy statement | Remuneration policy | Security | Statutory and Regulatory disclosures | Whistleblowing policy

Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. This website does not contain any personal recommendations for a particular course of action, service or product. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Before opening an account, please read the ‘Doing Business with Fidelity’ document which incorporates our client terms. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund.

This website is issued by Financial Administration Services Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) (FCA Register number 122169) and registered in England and Wales under company number 1629709 whose registered address is Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP.