How it works in practice

This example is for illustrative purposes only. The value of investments can fall as well as rise, so you may get back less than you invest. Past performance is not a reliable indicator of future returns. The return shown here does not take account of charges which would reduce these amounts.

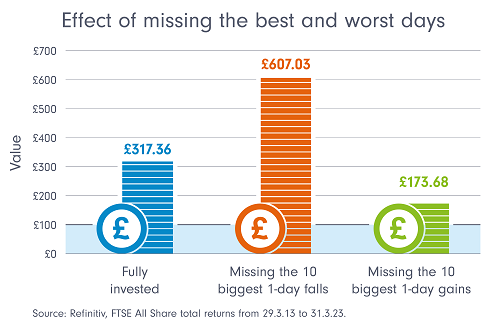

Take two investors. Harry attempts to time the market and manages to miss the 10 worst days in the market. Odine attempts to time the market but misses the 10 best days in the market.

By managing to avoid the worst days, Harry gets better returns. Odine, who missed the best days, does worse.

Ideally, you'd be like Harry and not Odine - but the chances are you won't be able to get the timing decision right on a consistent basis. That's why it might make sense to take a third option - simply stay invested and avoid the risk of getting your timing wrong. By taking this path, you don't have to worry about making the right decisions.